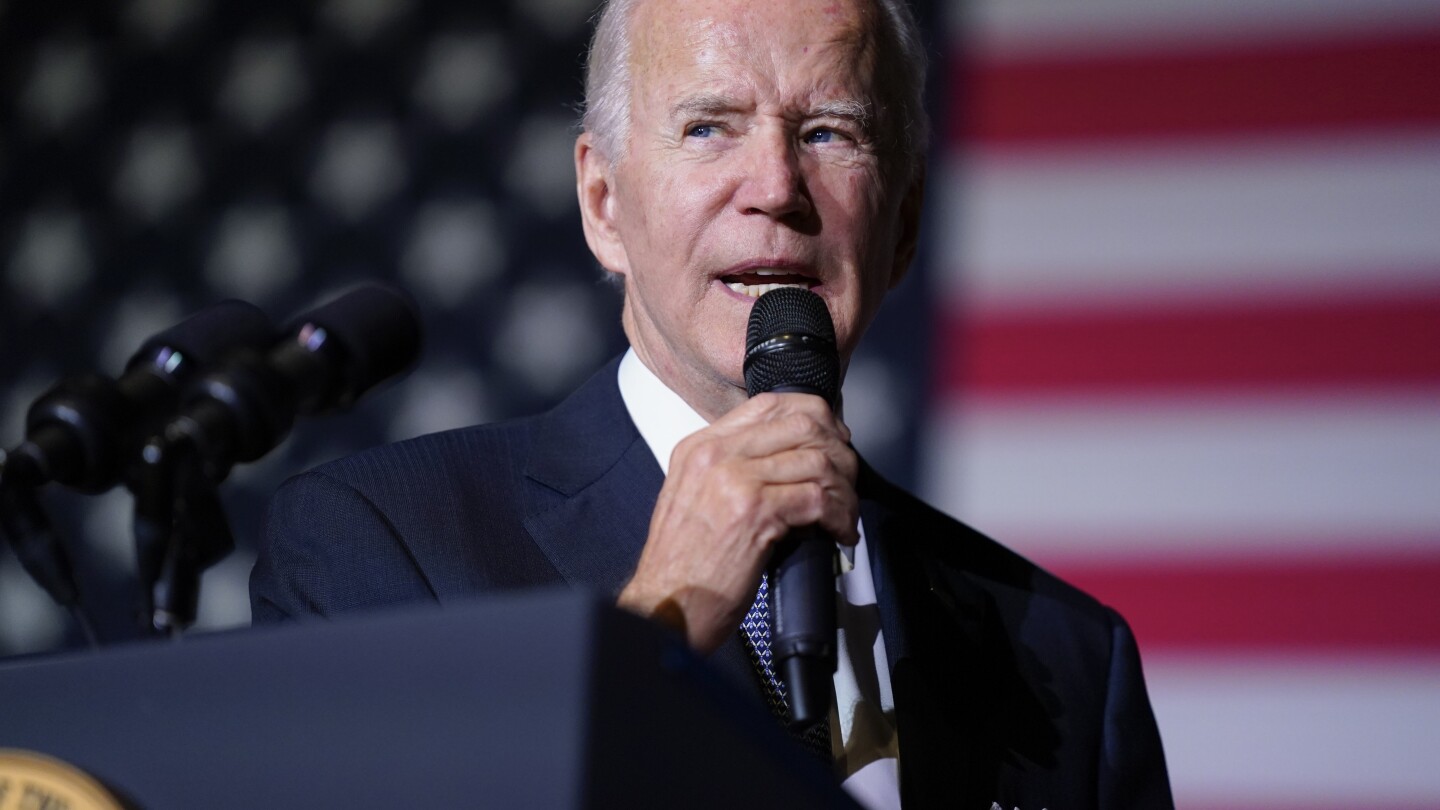

The Biden administration calls it a “student loan safety net.” Opponents call it a backdoor attempt to make college free. And it could be the next battleground in the legal fight over student loan relief.

…

HOW IS BIDEN’S PLAN DIFFERENT? As part of his debt relief plan announced last year, Biden said his Education Department would create a new income-driven repayment plan that lowers payments even further. It became known as the SAVE Plan, and it’s generally intended to replace existing income-driven plans.

Borrowers will be able to apply later this summer, but some of the changes will be phased in over time.

Right away, more people will be eligible for $0 payments. The new plan won’t require borrowers to make payments if they earn less than 225% of the federal poverty line — $32,800 a year for a single person. The cutoff for current plans, by contrast, is 150% of the poverty line, or $22,000 a year for a single person.

Another immediate change aims to prevent interest from snowballing.

As long as borrowers make their monthly payments, their overall balance won’t increase. Once they cover their adjusted monthly payment — even if it’s $0 — any remaining interest will be waived.

Other major changes will take effect in July 2024.

Most notably, payments on undergraduate loans will be capped at 5% of discretionary income, down from 10% now. Those with graduate and undergraduate loans will pay between 5% and 10%, depending on their original loan balance. For millions of Americans, monthly payments could be reduced by half.

Next July will also bring a quicker road to loan forgiveness. Starting then, borrowers with initial balances of $12,000 or less will get the remainder of their loans canceled after 10 years of payments. For each $1,000 borrowed beyond that, the cancellation will come after an additional year of payments.

For example, a borrower with an original balance of $14,000 would get all remaining debt cleared after 12 years. Payments made before 2024 will count toward forgiveness.

HOW DO I APPLY? The Education Department says it will notify borrowers when the new application process launches this summer. Those enrolled in an existing plan known as REPAYE will automatically be moved into the SAVE plan. Borrowers will also be able to sign up by contacting their loan servicers directly.

It will be available to all borrowers in the Direct Loan Program who are in good standing on their loans.

…

The Biden administration formally finalized the rule this month. Conservatives believe it’s vulnerable to a legal challenge, and some say it’s just a matter of finding a plaintiff with the legal right — or standing — to sue.

But you get why people don’t think voting matters, because change takes so goddamn long it’s not worth losing the extra shift at work.

If what you’re doing is indistinguishable from doing nothing, maybe do something else.

Change takes even longer when politicians give up.