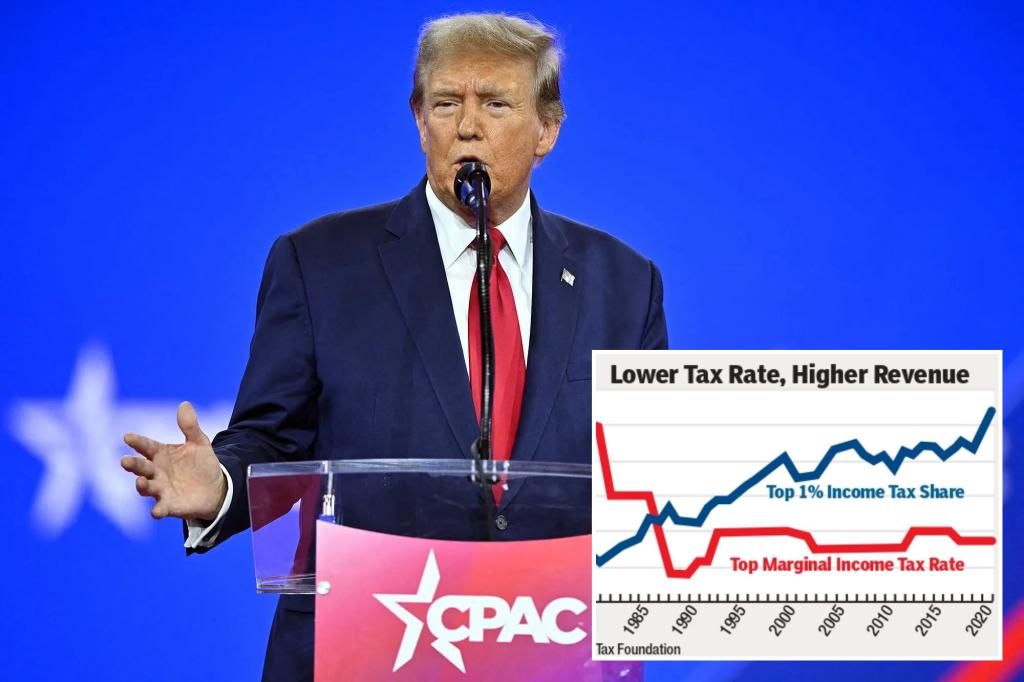

The latest IRS data on who bears the income tax burden demonstrate yet again the benefits of lower tax rates over higher rates.

When President Donald Trump entered office, the richest 1% of tax filers ($675,000 income and above) paid a little more than 40% of the income taxes collected.

The 2017 Trump tax cut reduced the effective highest federal tax rate to 37% from 42%.

But the most recent IRS tax return data (for 2021) confirm that even as these rates were lowered — not to mention the corporate tax rate cut from 35% to 21% — the share of the tax burden shouldered by the 1% rose to almost 46%.

Written by the guy who came up with the Laffer Curve, Arthur Laffer.

Are you able to offer anything other than dismissive labels?

Sure. But why would I bother when I know you’re just going to keep spamming your usual slop regardless?

Why do you two just go in circles all the time? Why not just Ignore each other?

Because just letting disinformation go unchecked is overall bad for the community

You’re not checking anything. You’re just saying “that’s [label]”

Possible labels:

slop

garbage

drivel

etc

To actually counter disinformation you have to actually explain why it is disinformation. Or else all you’re doing is a one man circlejerk.