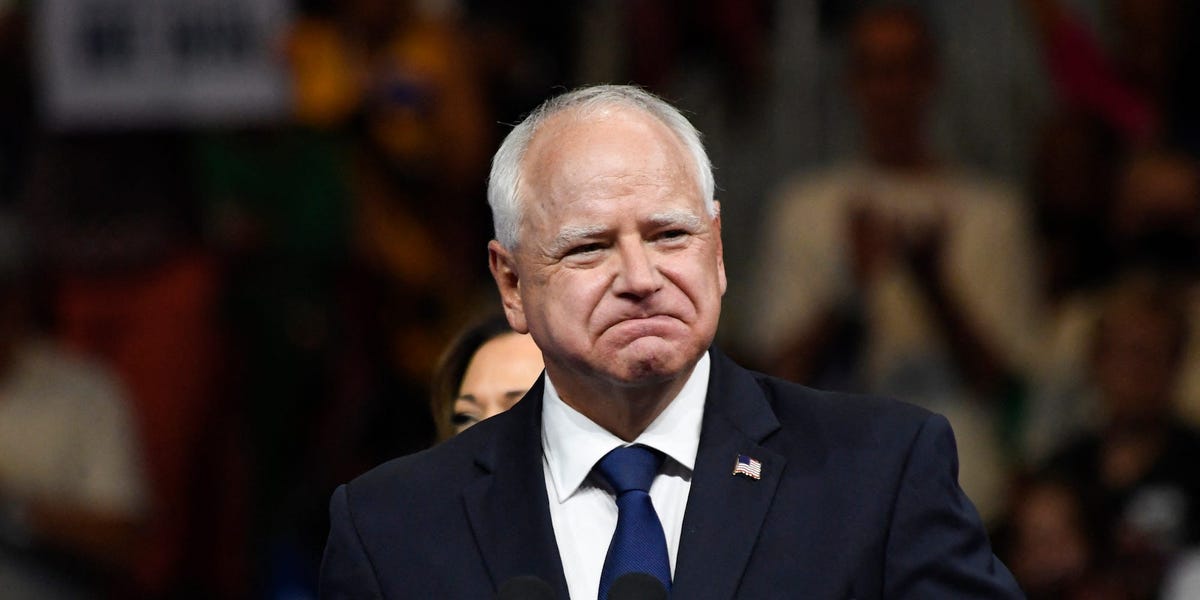

- Gov. Tim Walz of Minnesota is a man of relatively modest means, according to financial disclosures.

- In fact, he doesn’t own a single stock.

- Like other members of Congress, Walz even slept in his Capitol Hill office for some time.

dude doesn’t give a fuck about the shareholders 😮 where are my pearls?

“oh no, he wont care if my stocks fall” - finance bros, probably

Damn if a triple digit income is living relatively modestly I’m the fucking Buddha.

Must say though, the media is doing an ok job of selling me on this pick.

POV: you’re on disability benefits, given 8k per year, and the government/ruling class treats you as if you’re stealing money and lazy

Also the ruling class/govt: Triple digit salary is relatively modest

The key word is relative. Relative to the working class? No. Relative to his peers, the many politicians taking advantage of kickbacks and insider trading? Absolutely.

False equivalence. One is moderately paid and the other should be paid and treated better. Life isn’t a zero sum game and we can work together to make the world better for all.

well none of the politicians, democrats uncluded, have made any real effort to increase disability benefits in the past 2 decades. despite disabled people being homeless en masse

That has nothing to do with Democrats and Republicans. It is human nature. Humans suck but we could improve that with some effort. Most seem uninterested.

Isn’t triple digit from $100 to $999? As in composed of numbers made up of three digits. That would be poverty level.

Current congressional and VP salaries are described as “6 figs” or “6 figure salary” as far as I’ve heard.

It’s still good but they generally have to keep two residences: one on their state and one in/near DC. That’s not cheap.

He told the New York Post in 2018 that he shared an apartment in Washington, DC, with Rep. Patrick Murphy — each paying $1,800 a month

$22,000 a year out of $174,000. It’s not ‘cheap’, but I’d do it in a heartbeat if it meant I got such a payrise.

Me neither, Tim. Never have, never plan to buy any. If somehow I inherit some stock, I won’t know what to do with it.

Do you have a retirement account like a 401k or IRA? That’s almost certainly invested in stock.

I do not.

That’s honestly terrible finances unless you have a pension like Walz

Worth keeping in mind his pension is definitely in stocks (and other investments too, of course). So he doesn’t own stocks, but the portion of the pension he owns is stocks.

I did, but I cashed it out for food and shelter.

So you own stocks of food.

I do (2 in fact) and they’re locked in. I can’t do anything with them or to them except add more money (that I don’t have).

I’d like to know who made the rule that RRSPs, 401Ks, etc MUST be invested in the stock market instead of GICs or other forms of investment. Because if I had a choice I wouldn’t have one red cent in stocks.

MUST be invested in the stock market

You can invest in bonds instead if you want to. Less risk, less reward.

I’m in my 30s so my investment portfolio is around 90% stocks and 10% bonds at the moment.

According to the terms (both are from former employers) the stock market is it. I have no other options.

That doesn’t sound right, are you sure? The choice for investing in the bonds usually looks very similar to the others. Not saying you’re wrong, just that it is peculiar.

I’m Canadian, so when I transferred one of the RRSPs to my bank after I left that job, the bank showed me the paperwork that stated the RRSP had to be invested in stocks.

Ah, okay. I don’t know how it works in Canada. In the US our 401ks are more like mutual funds. We have a few options we can choose. Many of them track popular stock indices (like S&P 500). Our IRAs can invest directly into stocks though.

I also don’t know if you have to invest in the Canadian stock market or can invest in any, but there are definitely ETFs (which you buy and sell as stocks) that track bonds. So even if you can’t directly get bonds you can still essentially get bonds.

The scope of this is a little more in depth than I’m prepared to write in a Lemmy comment right now, but you can get many different types of bonds as ETFs. You can get target date ones that are the closest to the traditional bond experience (guaranteed return if you hold until maturation). You can get ETFs that are a mix of government bonds. You can even get ones that are a mix of all types of bonds (including corporate bonds).

All that to say, if you must invest “in stocks” you can still probably get some that are close to bonds.

If you have a 401k, HSA, or other common financial accounts offered by employers, you most likely have money in the stock market. Usually it’s an indexed mutual fund of some kind.

I haven’t read the article, but usually when people like this don’t have any stocks, it’s to avoid a conflict of interest, but they do potentially own something like a whole market etf that’s being managed by a 3rd party. Something like XGRO

That varies though. Some really do have nothing.

Edit: And while it seems like in this case it’s true to the intent, technically, owning an ETF share isn’t owning a stock. You don’t own the underlying stocks with ETFs

Yeah, I don’t own stocks. I just have a 401k and shares of VTI, VXUS, and VOO in my IRA and traditional brokerage. But I don’t own stocks!

To be honest though, I don’t see a problem (or at least as big of a problem) with politicians owning total market index funds.

To be honest though, I don’t see a problem (or at least as big of a problem) with politicians owning total market index funds.

Oh I totally agree with you on this. There’s no conflict of interest in that case so why not.

Honestly? That makes me really concerned about his long term wellbeing and raises a few orange flags for how he can be compromised. Owning individual stocks is very questionable. Investing heavily in a mutual fund or some other managed portfolio is common sense for anyone win a position where retirement is an option.

But also? Fuck yeah.

Things like mutual funds, IRAs, etc, are not considered securities and are not disclosed on economic interest disclosure forms. That is true for most government disclosures, including in Minnesota. Minnesota only requires disclosing directly held securities, like stocks, with a certain value. E.g., if you own $10,000 in Apple stock, that needs to be disclosed, but owning $10,000 in mutual funds shares does not.

He has multiple pensions from his different jobs.

Before America made us learn to be our own stock broker, and change jobs every 3 years for a pay raise, there were these retirement vehicles provided by employers that you worked with until you retired that you didn’t have to know anything about.

He has pensions.

Im surprised, he seems like a good person. So far the only critique I’ve heard is some people argue Josh Shapiro would have been a better pick.

Business Insider - News Source Context (Click to view Full Report)

Information for Business Insider:

MBFC: Left-Center - Credibility: High - Factual Reporting: Mostly Factual - United States of America

Wikipedia about this sourceSearch topics on Ground.News

https://www.businessinsider.com/tim-walz-kamala-harris-personal-finances-2024-8