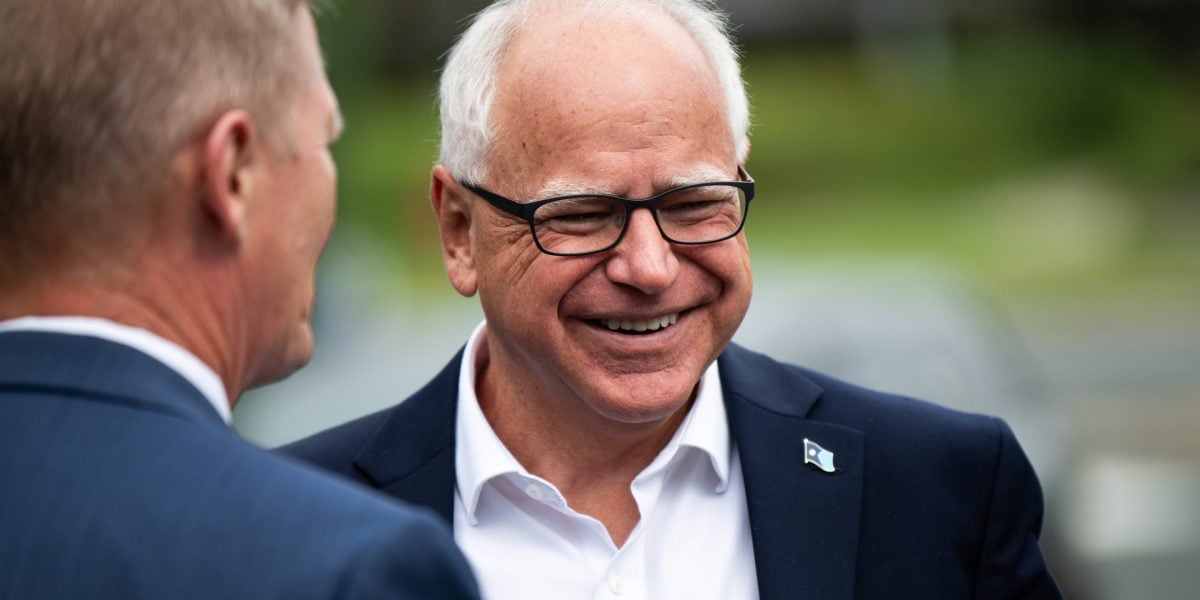

The all-American working man demeanor of Tim Walz—Kamala Harris’s new running mate—looks like it’s not just an act.

Financial disclosures show Tim Walz barely has any assets to his name. No stocks, bonds, or even property to call his own. Together with his wife, Gwen, his net worth is $330,000, according to a report by the Wall Street Journal citing financial disclosures from 2019, the year after he became Minnesota governor.

With that kind of meager nest egg, he would be more or less in line with the median figure for Americans his age (he’s 60), and even poorer than the average. One in 15 Americans is a millionaire, a recent UBS wealth report discovered.

Meanwhile, the gross annual income of Walz and his wife, Gwen, amounted to $166,719 before tax in 2022, according to their joint return filed that same year. Walz is even entitled to earn more than the $127,629 salary he receives as state governor, but he has elected not to receive the roughly $22,000 difference.

“Walz represents the stable middle class,” tax lawyer Megan Gorman, who authored a book on the personal finances of U.S. presidents, told the paper.

IRAs and other retirements savings can inherited if the person dies before or after they retire. Pensions can sometime be collected by surviving spouses, but are generally something you only get if you live long enough to receive them and they are not inherited.

The former is something you have (wealth), the latter is something you will get (future income). Kind of like the difference between the value of those shares now and what they could be worth in the future.

So you define wealth as only that which you can leave to survivors? That makes sense. I did some reading and it appears including pension in net worth calculations is something that varies among financial advisors. Some don’t even include the value of your home since you can’t readily access the value of that.

I’ve always thought of net worth as total assets minus total obligations/debts. And I view a pension as an asset. But given how you’re defining wealth, that makes sense why you would opt not to include a pension in net worth calculations.