Short seller

Brief

- Plug needs the DOE loan as a financial lifeline. It’s racing to finish the approval process before Inauguration Day, fearing the Trump administration may cancel it.

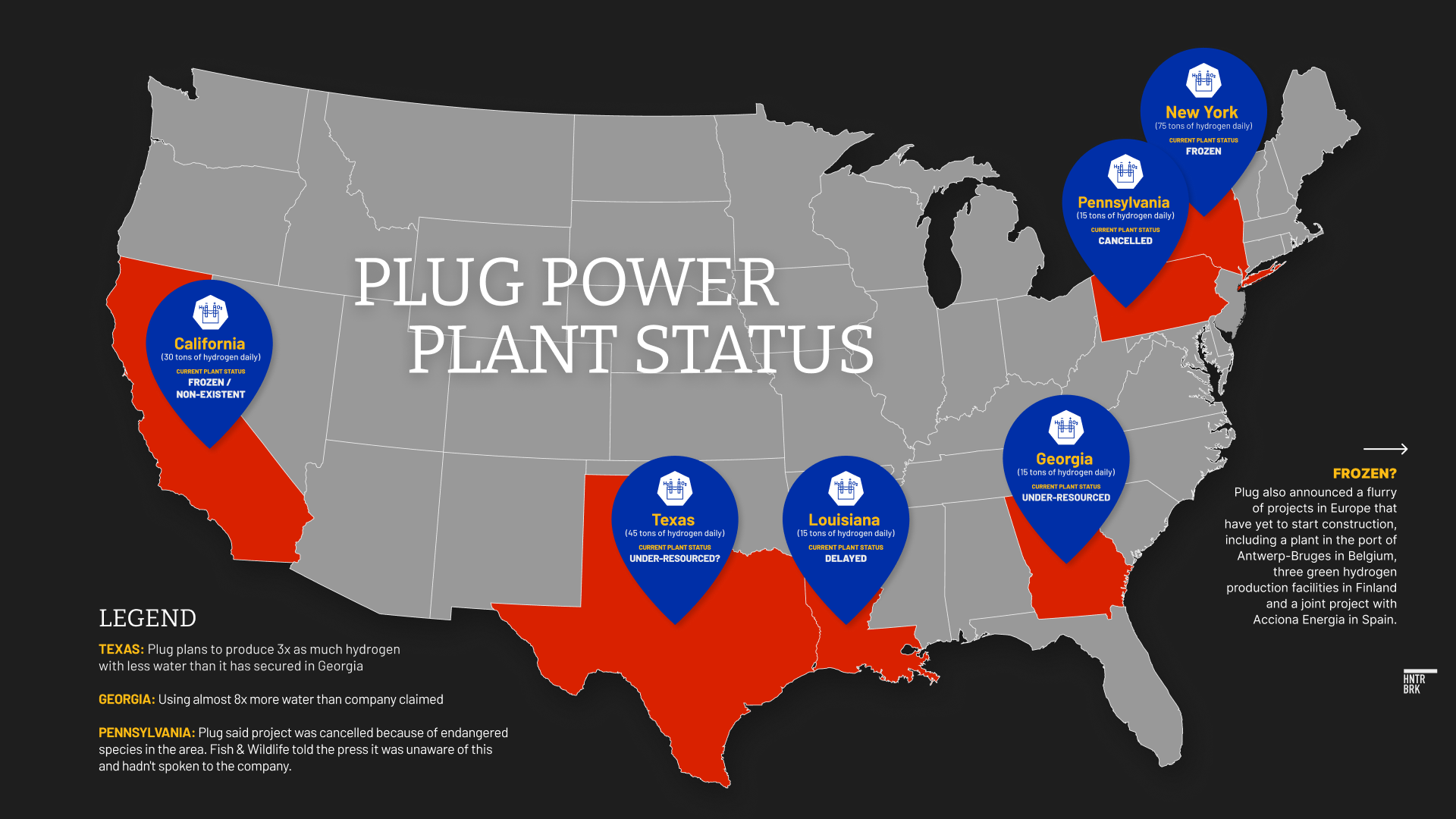

- A Hunterbrook investigation finds potential major roadblocks to getting the loan approved: Plug may not be able to secure enough water for planned hydrogen plants and may not have a credible plan for paying the loan back.

- Plug’s plant in Georgia uses at least seven times more water than the company publicly claimed. While Plug’s website says that the facility would use a maximum of 74,300 gallons of water per day, the company already has access to 587,520 gallons daily and stated in a groundwater withdrawal application that it will need up to a million gallons daily to operate the plant. Overall, Plug is aiming to secure a total of up to 1.7 million gallons per day for the Georgia facility.

- This threatens Plug’s planned expansion in Texas because the company only secured 500,000 gallons of water per day for hydrogen production at its new plant outside Dallas-Forth Worth, where it aims to produce three times more liquid hydrogen than it does in Georgia.

- Plug has consistently overpromised and underdelivered, according to a Hunterbrook analysis. Plug targeted producing 500 metric tons of liquid hydrogen per day by the end of 2025, but to date has managed only 25 daily metric tons and appears likely only to add up to 15 metric tons per day next year. That’s less than 10% of Plug’s goal.

- Part II of this investigation, an accounting analysis that will be published later today, reveals Plug is running out of cash. The company could go bankrupt within a year if the DOE loan doesn’t come through, and may not last much longer even if it does, according to Hunterbrook Advisor and NYU Accounting Professor Nick Gibbons — creating the risk that Plug could default on the loan and become the next Solyndra.

- Neither Plug nor the DOE responded to repeated requests for comment on what, if any, water use statistics the company shared with the agency as part of its LPO application process.

Might be dumb as fuck question but didn’t see it addressed, what does it mean the NY plant is frozen? We got blasted with snow the past week so I was wondering if it literally meant frozen or if it was like assets frozen.