Following the catastrophic failure of its sole clinical program, BioAge Labs (NASDAQ: $BIOA) fell to around $150 million market cap despite over $300 million in cash and a potentially valuable preclinical asset.

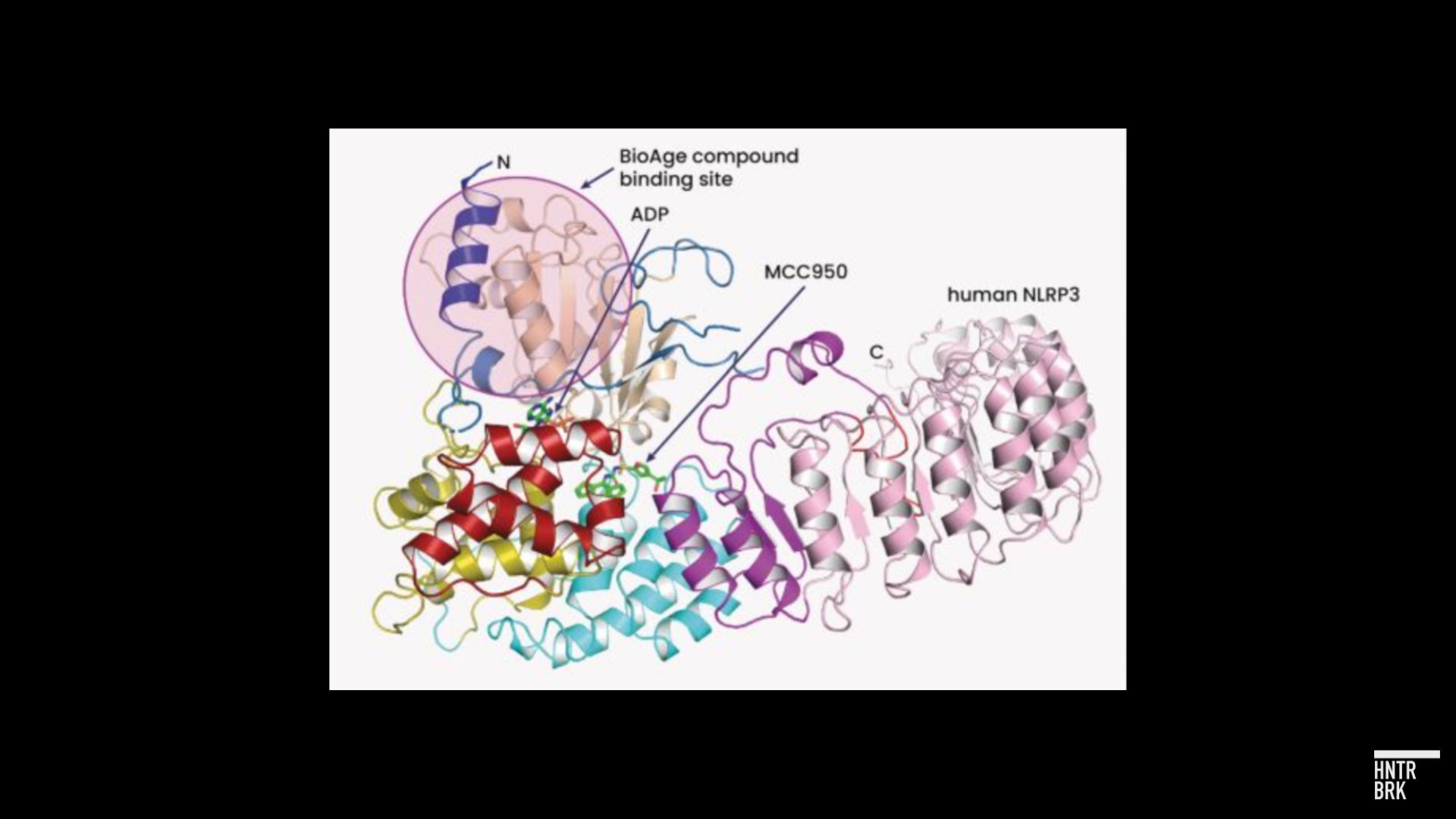

That new lead program is a drug for the inflammation protein NLRP3, a popular target: Analogous NLRP3 programs have scored deals worth hundreds of millions from pharma giants Novartis and Novo Nordisk to treat a wide range of inflammatory diseases.

“I believe that NLRP3 is among the greatest immunology targets of our time,” the CEO of Novo Nordisk’s development partner, a BioAge competitor, told Hunterbrook Media.

This week, BioAge announced a partnership with Novartis for other programs to target age-related diseases, building on BioAge’s founding mission to fight aging. The deal includes a $20 million upfront payment and up to $530 million in future payments.

The day before the partnership, $BIOA had traded under $4, with about $10 in cash per share. In similar cases, companies have been dissolved to return cash to shareholders or used as shells for reverse mergers to take other companies public. But now, with the Novartis partnership and a massive war chest, could BioAge live a second life with its new lead program?