- cross-posted to:

- [email protected]

- [email protected]

- cross-posted to:

- [email protected]

- [email protected]

I never thought Russia would be the main argument for getting Western Europe off gas and oil.

You should clarify that it’s getting off Russian gas and oil. Overall gas and oil will stay, just from other sources.

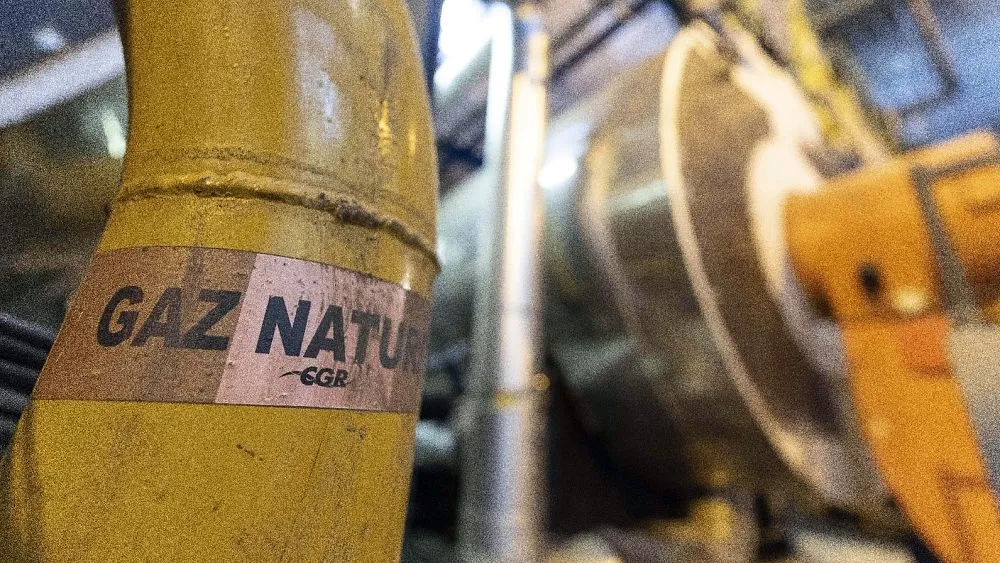

Gas pipelines bind end points together. The buyer is depended on the supplier, the supplier on the buyer. With Europe buying way more LNG now to replace Russian gas, the seller can be across the Atlantic Ocean. For oil this has always been the case with oil tankers.

Buying happens now on the international market instead of the pipeline end points (in Russia).

There was a massive decrease in natural gas consumption in Europe. LNG was not able to replace all of it, so alternatives and saving decreased consumption. There are also a number of laws and investment changes away from natural gas. LNG is just more expensive then pipeline gas and the EU wants to move away from fossil fuels anyway, so investments are not that intressting.

There are 2 different things going on.

Last year natural gas spiked in price due to Russia invading Ukraine. Because of the shortage and high price, there were successful attempts in various sectors and countries to reduce gas usage immediately. Hopefully some of the reductions measures will stay for longer and not just 1-3 years until the supply situation stabilised again.

Gas is planned to use in long term for a lot of EU countries and there are also huge investments planned. There is an absolute dependency on the resource for years and probably decades ahead. With markets exiting coal due to high CO2 prices, gas will become even more prominent to regulate the grid/demand across the day or as emergency plants for bad renewable days. In some EU countries, gas is the major source for electricity generation and overall it’s more looking to get higher than lower in the next 10 years. Even though LNG is more expensive, that price will be paid and of course forwarded to the end user. But that higher price will also help to push for renewables harder than with cheaper pipeline gas.

Just some numbers regarding the importance of natural gas for electricity. So not even accounting for the vast industrial/chemical use or heating (district & detached houses) purpose.

Gas TWh Public net electricity generation 2022

- Belgium 20 TWh (22.6%) with nuclear (42 TWh) phase-out ahead and no coal plants

- France 42 TWh (10%)

- Germany 45 TWh (9%) with coal (161 TWh) phase-out ahead

- Greece 19 TWh (48%)

- Italy 117 TWh (48%)

- Netherlands 36 TWh (36%) with 80% fossil generation

- Portugal 16 TWh (40%) with no coal plants

- Spain 77 TWh (29.5%)

- [UK 2020, 95 TWh (40%) with barely coal or hydro]

In Western Europe basicly only Germany has a lot of coal electricity, which might be replaced with natural gas. However fossil fuel electricity generation has fallen in the last decade, due to strong built up of renewables and that happend with a nuclear exit. If that built up continues then it is very likely that gas consumption is at least stable in Germany. For the rest of Western Europe more renewables means less fossil fuel consumption, which in basicly all cases is mostly natural gas right now.

Then there is heating. For all of them there is a strong heat pump sales growth. So a lot of gas heating will be replaced with heat pumps.

Industrial consumption matters and will likely fall a lot as well as companies invest in alternatives such as large scale heat pumps.

Germany is currently planning to add 25 GW of new gas plants for electricity generation to enable the coal exit and still have capacities for bad renewable days. Gas consumption for electricity generation will increase immensely. Especially when thinking about the topics you mentioned regarding other gas usage that is going to get replaced by more electricity usage.

Just look at bad renewable days with not much wind or sun, e.g. week #4 this year: https://www.energy-charts.info/charts/power/chart.htm?l=en&c=DE&week=04 (Lemmy is breaking the link, just click on the right side on week #4 to change the display)

Both coal types together run at about 30 GW on such days, with gas adding another ~12 GW to the fossil load. Even with adding more renewables over the next years, there needs to be a solution for bad renewable days - which will be the new gas plants. The plants are still in an early funding stage so this will take years to get them up an running. But time is ticking when looking at the early coal phase-out date.

Every country just needs something they can turn on when there are bad renewable days. And as you are saying, for many other EU countries that is already natural gas. So it will stay on the menu for decades, as it also works great together with daily load balance and renewables. Flame on - flame off, most flexible plants.

Thats what the 25GW of natural gas power plants for Germany turned into. 4.4GW of hdrogen power plants, another 4.4GW of mixed hydrogen and natural gas power plants and up to 15GW of natural gas power plants, which have to be ocnverted to hyrogen by 2035.. There is also the problem of some coal power plants mainly lignite being baseload. This means they run even when renewables are available. So there is no need to replace all coal electricity with gas. Even more to the point, battery storage is growing relativly well in Germany, which should reduce gas consumption, when only short periods need to be covered, which is very common. All in all German gas consumption might increase, but with some trade and so forth, it might also just stay stable.

But I would strongly recommend, that you look at Spain and Italy. Both operate gas power plants even during sun hours of sunny days. So a bit more solar and that is going to reduce consumption by a lot. Propably more then Germany running full power gas power plants for a few weeks each year.

I never thought Russia would be the main argument for getting Western Europe off gas and oil.

We must be careful with such generalisations. In Austria, for example, the country’s dependence on Russian gas has increased since the invasion in Ukraine.

This is the best summary I could come up with:

Gas storage across Europe is now filled at just under 90% capacity, reaching a mandatory target to ensure the continent can power itself through winter with months to spare.

These fears were realised shortly after in retaliation against wide-ranging economic sanctions imposed by the EU as well as a pledge to stop all Russian fossil fuel imports.

The abrupt cut-off from Russia sparked concerns the EU could suffer winter blackouts, prompting governments to prepare worst-case scenarios including rolling power cuts.

Gas storage levels at the beginning of April – or the end of the heating season – were 56% full, well above the five-year average of 34%.

The EU executive has touted its platform as a ‘remarkable success’ but kept mum on prices, stating it does not take part in negotiations between buyers and sellers.

However, reliance on foreign suppliers for gas means the EU remains vulnerable to price fluctuations.

I’m a bot and I’m open source!