Is that real? It seems incredibly stupid.

It’s from Reddit.

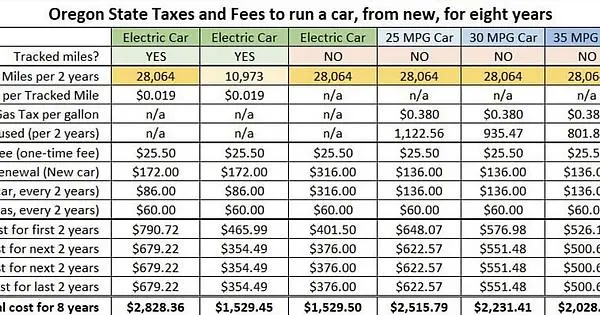

Hey r/Oregon … could someone double-check my math on this? Because it seems like, for electric cars, the pay-per-mile MyOReGo system only pays off if you’re driving less than about 5500 miles a year.

Anyway… I wanted to compare the costs of paying the State of Oregon to license/register and run an electric car vs. a gas-powered car for eight years. I also wanted to compare the costs of pay-per-mile (MyOReGo) vs. paying a flat rate for electric cars and the flat rate + gas tax for gas-powered cars. For the reg fees I gathered the info from ODOT, here.

I assumed that the owner lived in Clackamas county, that they drove 14,032 miles per year which is supposed to be the average for Oregon, and used $0.38 as the state gas tax value. The one exception to this is the third column, where I hopefully correctly figured the max number of miles someone could drive on the pay-per-mile system before it started costing more than the every-two-years flat registration/renewal fee.

I have purposefully not included any electricity costs for the electric car. I understand that would obviously increase the costs, but this is more about what the BARE MINIMUM costs are to legally run a car, from brand new, for eight years in Oregon. So, I assumed 100% of the electricity and charging is from home solar.

So… have I missed any “bare minimum” costs? Meaning are there any missed electric car taxes/fees or gas-powered cars/fees I missed? Or have I potentially included some fee that wouldn’t be applicable somehow? Or - as the math seems to indicate - is MyOReGo/pay-per-mile a huge extra cost assuming that you drive the average number of miles per year?

Final note: I very sincerely hope this isn’t controversial. This isn’t supposed to be an electric vs gas cars thing. I’m not trying to say that one IS or SHOULD BE less expensive than the other. I’m not saying that electric or gas cars should pay more or less. Etc.