I was horrified by the contents of one of my Finnish mutual funds when I looked into it after years of disinterest. I’m especially disgusted by UnitedHealth Group Inc - the health insurance company whose mass murderer CEO got shot recently, sparking nationwide cheers.

As a passive investor, you’ll forget your money into the wrong hands when the bank won’t remind you of developments in the political situation.

Ålandsbanken promises:

“socially sustainable”

You may assume your bank is civilised, but you should have a closer look. I’m a customer of S-bank in Finland. In this case, the fund ended up under a different Finnish bank twice due to buyouts, and the management of the fund ended up in a Canadian bank branch in the UK.

My other bank didn’t recommend selling my Russian investment when Putin’s reign had started going overdue after his full term as a president. Luckily I was awake and sold everything.

Investments drift out of balance over time. Within mutual funds, there are limits, but the funds grow at different rates. You should re-balance your diversification once in a while to avoid excessive country risk.

I don’t know if fund managers are bribed to distort the balance within the fund’s limits for the benefit of a third party.

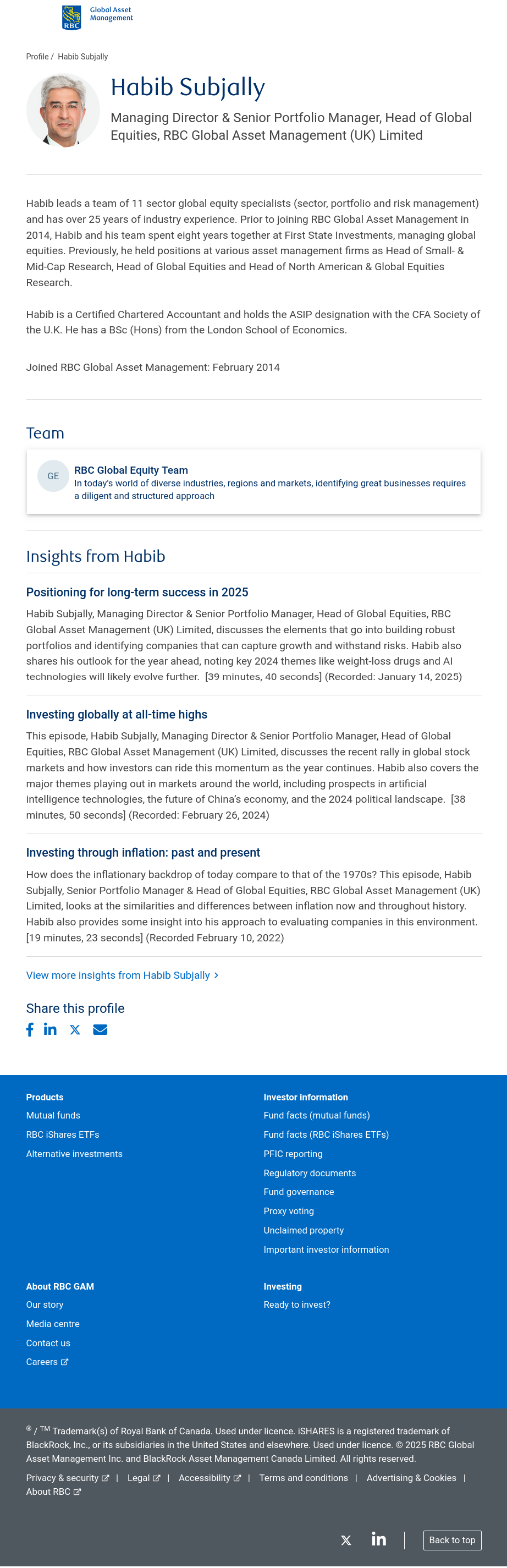

My fund is managed by that guy. I sold everything. Will reinvest in Europe.

Usually index funds outperform active investors.

https://en.wikipedia.org/wiki/A_Random_Walk_Down_Wall_Street

https://www.cnbc.com/2020/11/24/heres-when-active-mutual-funds-tend-to-outperform-index-funds.html

Define “active investors.”

Edit: how dare I ask a question!