Weapons manufacturers across Europe are rushing to secure contracts after EU countries announced plans to dramatically increase defence spending. Share prices of European arms companies had already risen sharply following the US decision to suspend military aid to Ukraine.

Under the “Rearm Europe” plan announced by EU Commission President Ursula von der Leyen on 6 March, EU member states can boost defence spending even if it means breaking the bloc’s budget deficit rule of 3 percent of GDP.

Von der Leyen suggests the EU could raise “close to” €650 billion over four years, which would be added to a €150 billion loan to member states for defence investment, totalling €800 billion.

European arms manufacturers view this as a golden opportunity to compete against their US rivals.

Some deals are already in motion. During a meeting in London on 2 March, UK Prime Minister Keir Starmer announced a €1.9 billion agreement to supply 5,000 Lightweight Multi-role Missiles (LMMs) for use against drones and helicopters.

Thales Belfast, a UK-based subsidiary of French defence giant Thales Group, which produces NLAW (Next-generation Light Anti-tank Weapon) missiles for Swedish defence manufacturer Saab, is expected to benefit from the surge in demand. Saab specialises in aerospace, missile systems and military technology.

This is likely just one of many contracts that will be offered to European arms contractors, shifting the burden of providing Ukraine with weapons from the US to Europe’s “coalition of the willing” – EU countries together with the UK and Norway.

Arms manufacturers have profited substantially from the Ukraine conflict.

The share value of French company Thales increased by about 50 percent between the beginning of the Russian invasion on 24 February 2022 and the end of 2024.

Until now, according to the Ukraine support tracker of the Kiel Institute for the World Economy (IFW), EU countries plus the UK and Norway provided €61.94 billion in military aid to Ukraine, compared to €64.1 billion from the US between the start of Russia’s invasion and the end of 2024.

Weapons supplied to Ukraine since the invasion began include US F-16 and French Mirage-5000 fighter jets, US Abrams tanks, French Caesar howitzers, various missile systems, Patriot air defence systems, armoured vehicles, light weapons, millions of rounds of ammunition and US-made Javelin anti-tank systems that became a symbol of Ukraine’s resistance.

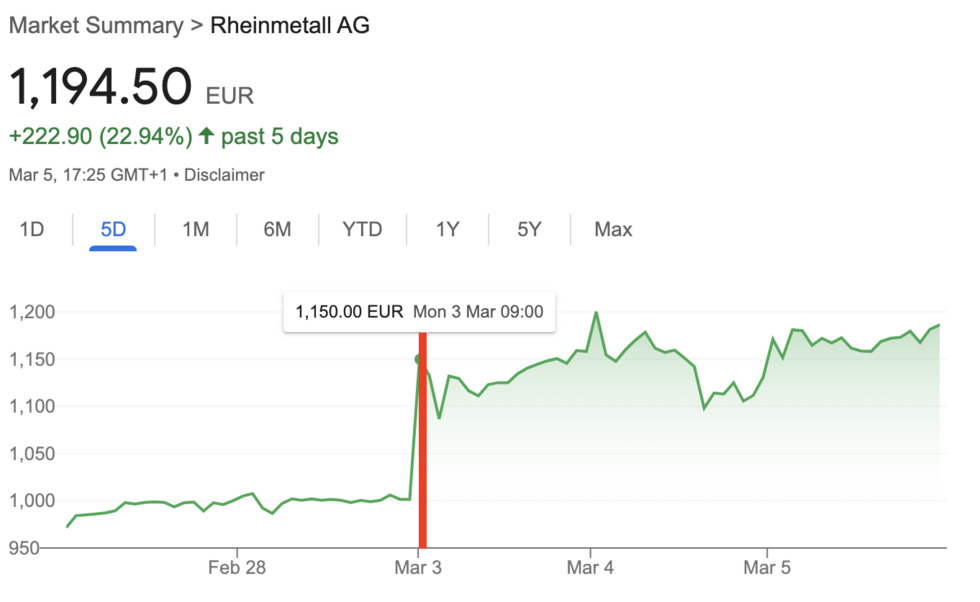

Following Trump’s apparent reluctance to continue military aid to Ukraine and Europe’s reaction, the effect on local weapons producers was immediate.

Market statistics show that performance of US defence companies had already fallen behind European arms companies before Trump’s election as US president on 5 November 2024. After his victory, the gap widened.

After Trump’s inauguration on 20 January and particularly following his announcement of plans to suspend military aid to Ukraine after a difficult meeting with President Volodymyr Zelensky at the White House on 28 February, Thales shares soared – as did those of other European arms manufacturers.

US policy changes could also impact Ukraine’s battlefield communications. The Ukrainian military has relied on Elon Musk’s Starlink satellite network since Russian strikes wiped out other communications systems.

But SpaceX, the company behind Starlink, has raised concerns about the network being used for military purposes.

Last month, SpaceX President Gwynne Shotwell said Starlink was “never, never meant to be weaponized,” adding that the company never intended for it to be used offensively.

US Treasury Secretary Scott Bessent has reportedly floated the idea of cutting Ukraine’s access to Starlink unless Kyiv agrees to grant the US access to critical materials such as rare earth elements, lithium, and other essential resources.

Now, Europe is looking at alternatives. Paris-based Eutelsat, the world’s third-largest satellite operator by revenue, is in talks to replace Starlink in Ukraine.

CEO Eva Berneke told Bloomberg that after “discussions about the Starlink potential pull-out of Ukraine,” Eutelsat shares more than tripled in value over two days, adding over €1 billion to its market capitalisation.

“It is a key element of modern warfare to have strong communications capabilities,” Berneke said. She added that discussions to replace Starlink with Eutelsat’s OneWeb satellite network “have intensified”.

Currently, Ukraine has around 40,000 Starlink terminals, nearly 10 times the number provided by Eutelsat. Berneke said the company could supply “a couple of thousand” terminals immediately but would need “a couple of months” to replace all 40,000.

Eutelsat’s system would eventually be part of the EU’s “Secure Satellite System” IRIS², a flagship project launched on 17 December. The hardware is supplied by Italian aerospace company Telespazio, a joint venture between Italy’s Leonardo (67 percent) and France’s Thales Group (33 percent).

On 6 March, Italian company Leonardo signed a deal with Turkey’s Baykar for a joint venture to produce drones as defence companies rush to respond to the surge in European military spending.

Increased demand may revive the EU’s Eurodrone project, a four-nation development programme involving Germany, France, Italy and Spain.

Meanwhile, the Czech Republic announced it will extend its Czech ammunitions initiative with Denmark, Canada, Portugal and Latvia, which already supplied Kyiv with 1.6 million rounds of large-calibre ammunition last year.

Overall, the biggest winners from the increase in EU defence spending are likely to be Germany’s Rheinmetall, France’s Thales and Saab of Sweden, while BAE systems of the UK is well-positioned to benefit from increased military budgets across EU nations.