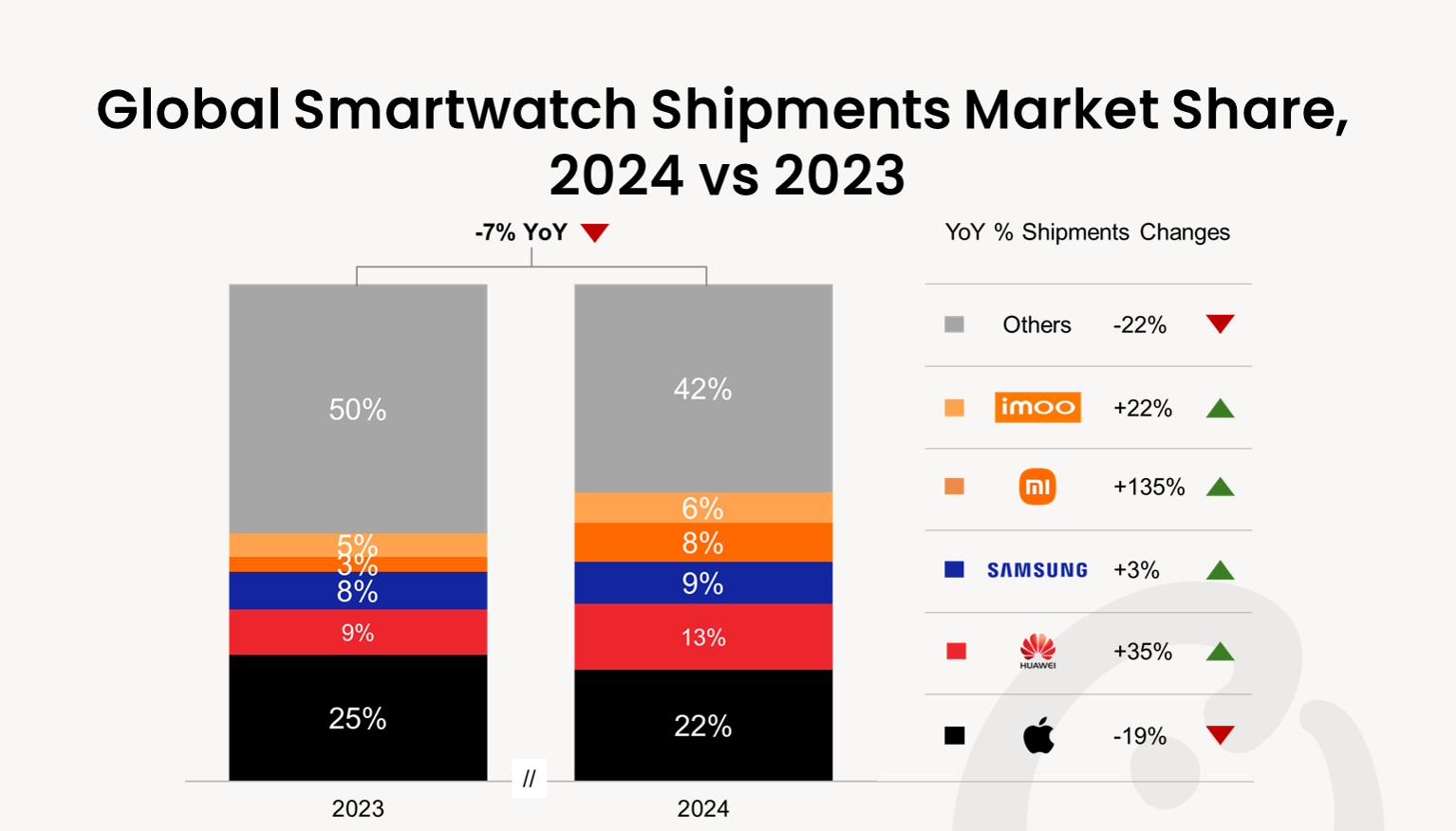

The global smartwatch market fell 7% in 2024, the first ever decline in the overall market.Apple retained its top position, despite a 19% YoY decline in shipments due to tighter competition and weaker upgrade cycles.China captured the biggest shipment share for the first time, driven by the strong performance of Chinese brands including Huawei, Xiaomi and BBK (Imoo).Kids smartwatch was the only segment to witness a rise, as parents' awareness increased, and brands expanded in this category.Seoul, New Delhi, Beijing, Hong Kong, London, San Jose, Buenos Aires, Taipei, Tokyo – March 10, 2025Global smartwatch shipments fell 7% YoY in 2024, the market’s first ever decline, according to Counterpoint’s latest Global Smartwatch Shipments Tracker by Model, Q4 2024. The downturn was primarily due to a decline in Apple’s shipments as the basic smartwatch segment saw lower upgrades amid a slowdown. Weakness in the basic smartwatch market originated in India, where consumer demand waned due to a slow replacement cycle, lack of innovation and unsatisfactory user experiences among first-time buyers.Apple retained its top position in the global market, hoisted by its growing iOS user base. Samsung witnessed 3% YoY growth, as its newly launched Galaxy Watch 7, Galaxy Watch Ultra and Galaxy Watch FE Series saw strong adoption. Xiaomi made a remarkable entry, experiencing the fastest growth in 2024 and securing a spot among the top five for the first time. The brand saw growth across all regions, propelled by its portfolio expansion and the strong performance of its Watch S1 and Redmi Watch series.Source: Counterpoint Research Global Smartwatch Shipments Tracker by Model, Q4 2024Commenting on Apple’s performance, Senior Research Analyst Anshika Jain said, “Apple Watch witnessed a decline in momentum on its 10th anniversary, despite the launch of the S10 series. The biggest driver of the decline was North America, where the absence of the Ultra 3 and minimal feature upgrades in the S10 lineup led consumers to hold back purchases. Additionally, patent disputes limited shipments in the first half of the year. The slowdown of the existing Apple Watch SE lineup and the lack of new SE models also contributed to the decline.”“In terms of regions, China, for the first time, recorded the highest ever shipments, surpassing NAM and India in 2024. Huawei, Imoo and Xiaomi were the front runners of the China market. Their diverse portfolios, ranging from basic, advanced to kids’ smartwatches, along with the Chinese consumer's inclination towards these brands drove the overall adoption,” Jain added.Commenting on the different smartwatch segments, Research Analyst Balbir Singh said, “Only the kids’ smartwatch segment witnessed growth with Imoo remaining the market leader driven by its affordable, feature-rich offerings. The kids’ smartwatch segment is gaining traction as parents are concerned for their children’s safety, and they desire to track and stay constantly connected with their children. With the decline of basic smartwatches, other brands such as Noise, boAt and Google’s Fitbit have started diversifying their portfolio to include kids’ smartwatches. This is a good sign for the market’s diversification and indicates further growth in the future.”Commenting on the global smartwatch market outlook, Associate Director David Naranjo said, “The smartwatch market is expected to recover slowly and witness single-digit percentage growth in 2025. Both Android and iOS smartwatches are expected to integrate more AI capabilities and advanced sensors to provide deeper insights into health data. For advanced sensors, smartwatches are expected to incorporate sensors for measuring bodily signals such as serious heart health tracking, focusing on atrial fibrillation, sleep apnea, hypertension, and diabetes. Brands will emphasize on getting regulatory approvals for their new smartwatch models and incorporating new health features to sustain their position in the market.”BackgroundCounterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.Follow Counterpoint

[email protected]

This shocked me when I went from my Galaxy Watch 3 to a Galaxy Watch 6. I used to only have to put a PIN when I wanted to pay, but now it’s anything on the watch?

Because of that, I also disabled the payment app.

I honestly don’t remember how pervasive the need for a PIN was on the Pixel Watch, but even if it was only for purchases, it would invariably take 10X as long to switch to the Wallet when I was at checkout, or I would fumble hitting the right numbers on the small screen.

With my phone, if I’m not unlocking it with my finger as I pull it from my pocket, I can do it as part of the payment process very easily.

The whole experience of paying with my watch was lacking. If the phone and watch are connected via BT, then I feel like the wallet on the watch should just work without a PIN. Or at most a voice confirmation.