- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

Summary

Tesla board members and executives have sold over $100 million in stock since early February as the company’s shares decline.

Board member James Murdoch sold $13 million in stock on March 10, coinciding with Tesla’s worst single-day drop in five years.

Kimbal Musk sold $27 million in shares last month, and board chair Robyn Denholm offloaded over $75 million through a predetermined plan.

The sell-offs come as Tesla’s stock has fallen nearly 50% since December.

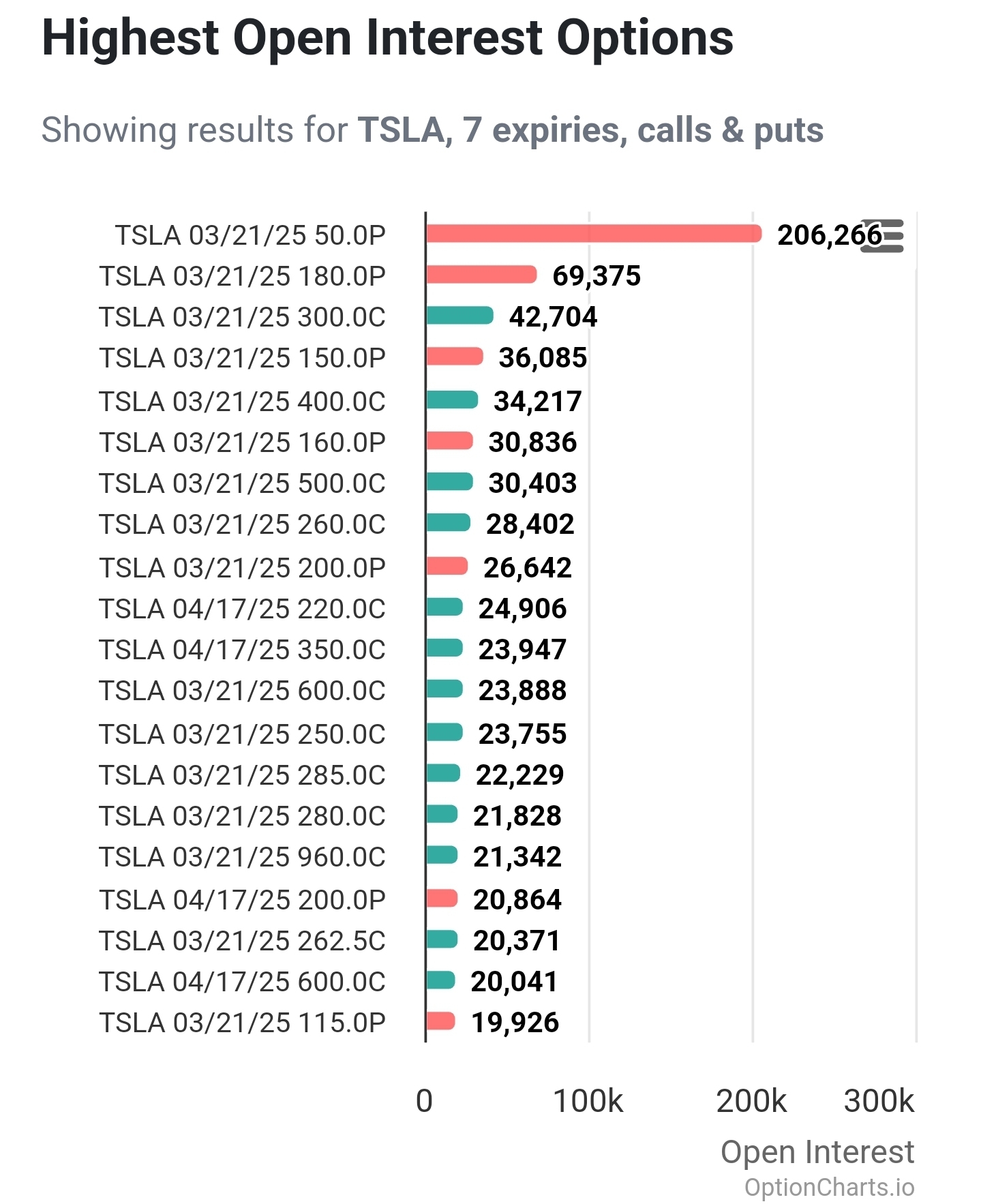

I wanted to join the selloff party so badly, I traded all my Total Market ETF holdings for (Tesla-free) Large Cap Value ETFs, and with the change left over I bought the cheapest Tesla Puts I could find.

I just love that open pessimism for Friday’s Put contracts!

I recognize that these are words. That’s probably why I’m poor.

I am mostly a disciple of Boglehead investing philosophy.

A seminal resource early in my adult life was The Wealthy Barber, which I think still stands up well as a sensible guide to low-stress, long-term investing.

An ETF is basically a thing you buy, like shares of stock, but each share of an ETF is made of a blend of a bunch of stocks. VTI is an ETF run by the brokerage Vanguard that tries to track the entire US stock market, weighted against how large a company is. You should try to find ETFs with a low “expense ratio”, which is basically the management fee for a blended fund. VTI is really low, something like 0.03%. So you pay vanguard $3 for every $10,000 gained (I think it works like that, anyway. All I know is it’s low and that’s good).

I don’t endorse playing with Options Contracts unless you have an iron stomach and incredible self discipline. It’s legalized gambling in my view (although it has other valid uses, like hedging against losses…but it’s an advanced tool and can wreak havoc on savings when used poorly).

I’m going to spend my money on more whiskey. I’m not sure if I’m too sober to understand or not nearly sober enough but we’re about to find out together.

So real talk, and of course I’m not going to toss my life savings (ha hahahahaha ha cries in american) into it but: how advisable is short selling Tesla right now and is there a reasonably “safe” way to do it? I know it always involves risk, especially in the event of a margin call, but for someone who is only slightly versed in these matter: how advisable would such a move be?

Is it possible or likely for a reverse-Gamestop ploy to take place?

I personally will never short anything. I’m not smart enough to do it right, I proved that to myself when I tried to actively invest. Were I to play the market again, if I were pessimistic about a stock, I would opt to buy Put Options to bet against it. Those come with their own risks, including being able to time the market in addition to its direction. I’ve seen others say you can buy positions in a ticker that tracks the inverse of Tesla, but it insulates you from the worst case of selling short (i.e. theoretical infinite loss, or at least way more loss than you could afford); it can only drop to zero for a 100% loss, but not more. At least, that’s my understanding, but I could be wrong. The advice I give myself is to just not play, except in the most boring way.