I recently read an article about OPEC, and how oil prices will likely rise for the next year or two. The article said this will cause a significant uptick in inflation indicators, so the Fed will likely raise rates.

I can understand raising rates in response to monetary inflation, but it doesn’t make much sense to me to raise rates in response to supply-side shocks. It also seems cruel since the goal seems to be to raise rates so more people become unemployed or underemployed so that can’t afford to buy gas.

The Fed only has a couple of tools to combat inflation, and none of them work very well for supply-side inflation. Personally I think they shouldn’t be raising rates to deal with supply-side shortages (ideally you’d want to make it cheaper for companies to produce more and decrease shortages), but politically speaking they need to show they’re taking some form of action to rein in inflation.

Just want to upvote this because I think it’s very important. The feds toolbelt is vastly limited nowadays. They basically are using interest rates as the only lever they can pull.

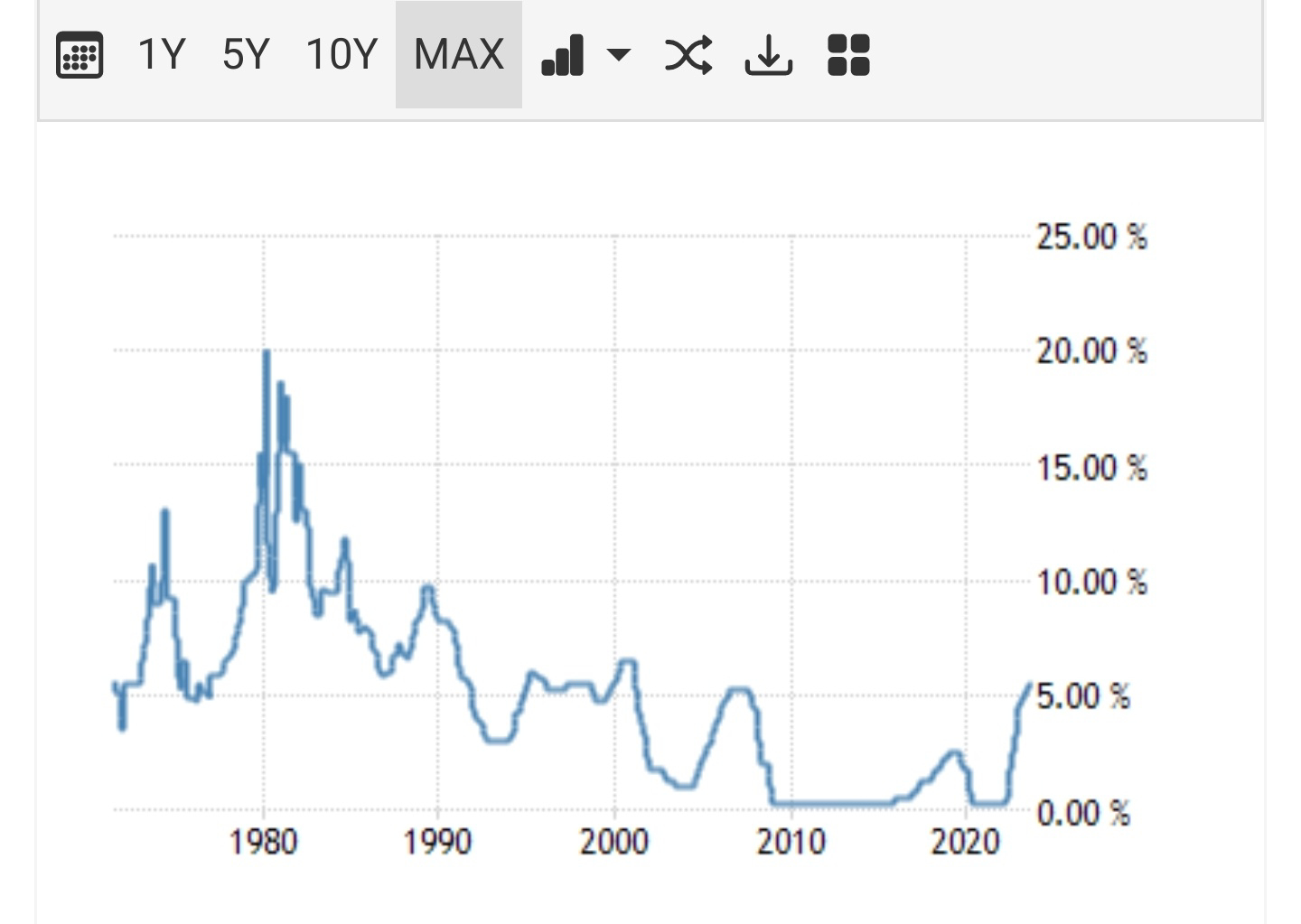

Rates have basically been zero for the last 15 years. When the market normalizes zero percent rates, anything to the contrary will have a compounding negative impact.

Or, the legislators can do their jobs. Oh wait, the Republicans have a majority in the house. Never mind.

I am old enough to remember when fiscal policy was a tool in managing economic shocks.

Yup. Ideally this would be handled through public policy changes, instead of relying on a quasi-private institution that’s severely limited in its powers.

But apparently that’s too much to ask.

Because it encourages people to save money instead of spending it. If you can earn 6 percent on your money, instead of spending it it is better to save it

I could see that working for investments (if expected return on some are < 6%), but not for personal gas consumption. I.e. people aren’t going to put off a trip or bike to work to buy bonds. I suppose less investment in businesses (and costlier loans) could cause high energy projects like construction to be curtailed, lowering demand for oil (but also labor). Not sure if that’s better than the Fed doing nothing though; since higher fuel costs also curtail these things.

Think about it like this, 11% of Americans have ev’s. Those people are the ones with large amounts of disposable income, and probably the ones you want to slow down spending from the most. So fuel prices straight up don’t effect them.

You don’t want to reduce people’s ability to make ends meet directly. Instead, as most western governments, you need to play as the “invisible hand”. no one wants the economy to slow down, so you have to do it in a way that looks like money laundering, but for an economic slowdown. “What’s that? Banks are failing? Well they didn’t hedge their risk properly.” " a business lost money? While it looks like they should have prepared for customers buying patterns changing"

An unfortunate reality, is that this is the better option. Otherwise you end up with a massive crash, because the market, does. Not. Self. Regulate.

Normally what you said would be true, but our economy is currently very dependent on oil, so slowing it down also decreases the demand of oil, or at least this is my understanding… Of course with things like unemployment is a matter of balance I guess

Removed by mod