Semms like damn good news in a way

In a way kinda. It’s problematic though that China is using Uyghur forced labour to produce cheap solar panels.

This of course allows them to undercut any other manufacturer, driving them out of the market. So the delivery chain is getting kinda small and the products have forced labour attached to them.

“China uses Uyghur forced labour to make solar panels, says report” Published 14 May 2021 (Source: https://www.bbc.com/news/world-asia-china-57124636)

deleted by creator

deleted by creator

So long as demand is high enough to keep the businesses afloat, absolutely.

There’s an interesting economic crisis point coming alongside plummeting solar and battery costs. At some point soon, the cost of installing battery backed solar on private properties will be cheaper than the cost of the wiring for the grid. At that point, even if the electricity feeding the grid cost zero dollars to produce, the grid itself will cost more than generating your own power. So, from a purely financial perspective, anyone who has the space to install solar should install solar.

This leads to an interesting feedback loop. We can’t shut down the grid, because there are people in apartments and things that need it – not enough surface area on an apartment roof to generate enough solar. So they will still have to pay for the grid. With fewer and fewer grid connected buildings, however, the cost of maintaining the grid disproportionately goes to those without land. This dramatically alters the value of land in favour of those that own it. It feeds sprawl, and exacerbates the gap between the rich and the poor.

Industrial users will bear much of the grid cost – most factories cannot power themselves with solar, particularly those in high energy industries. But, it’s possible that the high energy factories just buy farmland so they can set up mostly autonomous facilities outside the cities. Not solar, but this is a good example: ammonia plant building its own wind farm in the middle of nowhere https://www.cbc.ca/news/canada/newfoundland-labrador/evrec-marine-group-wind-hydrogen-ammonia-botwood-grand-falls-central-1.6754995

Long short: expect there to be social disruption due to low solar and battery prices. Deurbanization is a likely byproduct.

deleted by creator

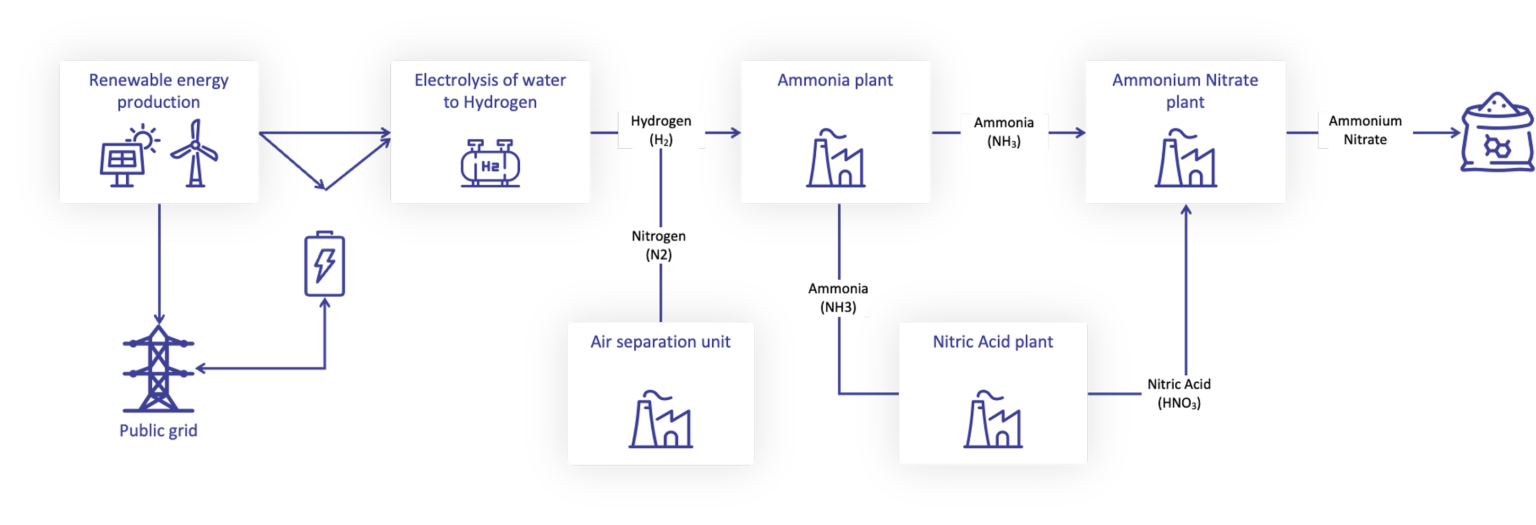

You might find this company interesting. Green hydrogen making fertilizer

No immediate tech info on their front-page. I’m assuming it is a solar/wind powered nitrogen fixation plant?

Full-scale plants using electrolyzers to produce hydrogen and then ammonia using Haber-Bosch synthesis have existed for decades. However, none survived into the new millennium due to high power prices and suboptimal design.

Atlas Agro has developed the technology further in order to adapt it to the characteristics of renewable production and in order to capture new developments in materials and design since the last renewable plants were built.

Ah, this is great!

I’ve a pipe dream that someone will use a similar pipeline to produce ethylene gas one day. Plastic from atmospheric carbon dioxide and water? Sign me up.

Yep, power companies love solar power, until they don’t.

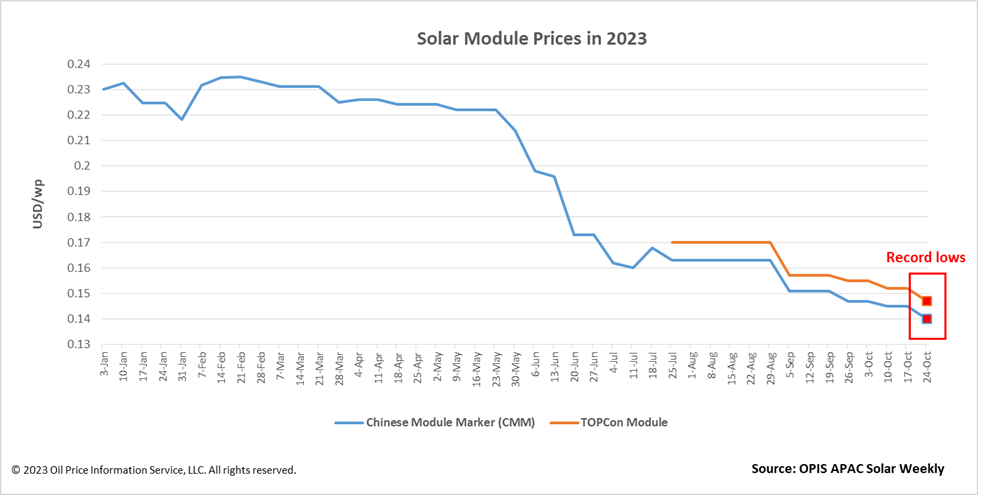

This is the best summary I could come up with:

Buyers and sellers of modules alike reported lower prices during OPIS’ weekly market survey.

While domestic demand will come from fourth-quarter installations, this is typically a low-demand period, concurred multiple sources.

Orders signed last quarter have been cancelled and buyers want to re-sign contracts at current low prices, another module manufacturer said.

The supply picture is gloomy, too, as China’s module manufacturers are sitting on 1-2 months of inventory, according to one seller.

Looking ahead, module prices are expected to continue falling as we reach the end of the year, OPIS learned during its weekly market survey.

Many sources pointed to how the 1 yuan/W era has arrived already, with a recent major China procurement tender seeing P-type module bids of as low as 0.993 yuan/W.

The original article contains 423 words, the summary contains 126 words. Saved 70%. I’m a bot and I’m open source!

Cheaper prices means more clean energy everywhere.