A homebuyer now needs to earn at least $114,000 a year to afford a $431,250 home – the national median listing price in April, according to data released Thursday by Realtor.com

The analysis assumes that a homebuyer will make a 20% down payment, finance the rest of the purchase with a 30-year fixed-rate mortgage, and that the buyer’s housing costs won’t exceed 30% of their gross monthly income — an often-used barometer of housing affordability.

Based off the latest U.S. median home listing price, homebuyers need to earn $47,000 more a year to afford a home than they would have just six years ago. Back then, the median U.S. home listing price was $314,950, and the average rate on a 30-year mortgage hovered around 4.1%. This week, the rate averaged 6.76%.

The American dream is now an outright lie, one perpetuated by boomers who lived the most charmed existence before pulling up the ladder behind them. Billionaires stole our future.

Owning a detached, single family home is always going to be out of reach for many, because they’re just inherently more expensive. It’s lower density housing that requires more land and infrastructure, per person. It’s less efficient use of space, it should be more expensive. The problem in the US is that higher density housing isn’t much less expensive, and that’s because there isn’t enough of it, and there isn’t enough of it because developers and investors aren’t interested in building low margin, affordable, quality apartments and condos. They’d rather build higher margin “luxury” housing. It’s “luxury” in quotes because it’s not actually high end. It’s priced as high end housing, but it’s actually quite cheaply built, with some high end veneer slapped on top. And thus, the high margins. Works great for developers and investors, but it’s a very bad deal for renters and buyers.

The problem in the US is that higher density housing isn’t much less expensive, and that’s because there isn’t enough of it, and there isn’t enough of it because developers and investors…

There isn’t enough of it because BUILDING IT IS ILLEGAL!!! This isn’t a failure of the market to build affordable housing, it is a failure of the government to allow affordable housing to be built due to the dominance of single family zoning! And furthermore, sfhs are cheaper than they should be because they are subsidized by the government - the taxes paid by sfh owners don’t even come close to paying for the maintenance costs for the infrastructure that serves them.

If you want to bring down housing costs:

- Liberalize zoning laws and strip nimbys of their power.

- Enact a Georgist tax scheme to preempt land speculation and ensure all land is being put to its highest and best use.

- Overhaul urban design standards, creating more walkable spaces with better transit and cycling infrastructure.

This isn’t a failure of the market to build affordable housing

It absolutely is.

I’m all for zoning reform. We should reduce or eliminate single family only zoning, and other unnecessary building requirements, in urban areas. But the idea that developers are champing at the bit to go build a lot of very low margin, quality, affordable multi family housing, and that the only thing holding them back is government regulations, is naive at best.

Right. Developers are champing at the bit to make money.

A lack of correctly zoned land and a plethora of red tape means that building multifamily will be extremely expensive, and thus, extremely risky. Thus, investors demand a high margin return for the risk they are taking. Upzoning and removing red tape increases the supply of land where you can build a multi-family unit, so investors are willing to accept lower-margin returns. It also opens the door to smaller local developers and cooperative developments. And the then expanded amount of multifamily housing drives down the cost of the luxury units as well.

One reason developers build luxury units instead of affordable units is that once they build, they can just sit on their investment and wait until people buy the units at the price point they want. Georgists tax schemes say “shit or get off the pot” - since they can’t profit from the underlying value of the land, they want to sell their units as quickly as possible so they can stop paying the tax. This incentivizes developers to build units that sell quickly, rather than units that sell for the highest price.

Upzoning and removing red tape increases the supply of land where you can build a multi-family unit, so investors are willing to accept lower-margin returns.

Are they? You seem pretty convinced, but I’m not so sure. Upzoning initiatives have been happening in various states and metro areas in the country in recent years, is there evidence that lower margin developments have increased in those areas?

That being said, I don’t necessarily oppose any of the measures you’re proposing, but, while they might work in theory, I’m not convinced they will achieve the results you believe they will achieve, in practice. I don’t think there’s anything wrong with trying this strategy, though. By all means, let’s try it, even if only as a trial somewhere.

https://www.texastribune.org/2025/01/22/austin-texas-rents-falling/

As in many other major cities, existing homeowners and neighborhood groups that opposed allowing more homes to be built for decades held significant sway at Austin City Hall. But those forces lost favor amid the city’s skyrocketing housing costs during the pandemic. Austin voters elected City Council members — including Vela — more friendly to housing development.

Now, Austin is one of the only major U.S. cities where rents are falling.

Well, that sounds great, then. I still think you’re being naive, and that you’re putting too much faith in the invisible hand of the free market, but, as I’ve said several times now, I’m not opposed to upzoning. Not at all. By all means, go for it.

Arguably, our whole approach to small housing spaces needs to be looked at. Unlike in the UK and a lot of other European countries, you can’t lease or buy out your apartment, which really leaves you at the mercy of your landlord or your property company when they sell out or decide to throw you out for someone who can pay more.

America is huge and has tons of unused land. Style of housing is irrelevant.

If you were a developer, would you want to build houses so fast that your revenue declined? Probably not.

If you’re a government, would you want housing values to decrease from all those built houses, and with it, property taxes? Probably not.

Follow the money.

Not all land is created equal. You can buy some land in rural Nebraska right now and build your own modest house for less than $100k. You’d just have to commute an hour to get to the nearest dollar store.

Allowing more multifamily housing allows people to live affordably while simultaneously being somewhere they actually want to live, without having all their utilities and services subsidized by the government (ie, subsidized by people and businesses which exist in efficient and non-parasitic forms of development).

And yes, a big problem is that many americans’ life savings is tied up in their home value. Hence, liberalization of zoning codes and an implementation of a new taxation scheme must be done such that the vast majority of home owners don’t lose huge amounts of wealth and don’t have their lives significantly disrupted. This is very doable in any number of ways.

Under a Georgists tax scheme, government revenue would likely increase.

Liberalize zoning laws and strip nimbys of their power.

Maybe zoning laws are bad, but I’m looking out of my window and see a mall that was built in place of a big square of grass where people would have picnics and sunbathe at summer in my childhood. The wind was also wonderful, and you could see all the way till the court building behind it from me (new, but not as ugly), and the ship-like Soviet enormous building on the side of it made the whole place beautiful. Now it’s just asphalt and that huge ugly mall in place of grass. Looks depressive and too expensive.

And right before my window there’s a two-story (almost 1.5) Soviet abandoned (some disagreement between ministry of defense that owned it in Soviet times and someone they illegally sold it to, there was some deadlock in deciding who owns it) cinema building, apparently the legal problems have been resolved and instead of it I might behold a buttfuck-ugly 5-story building instead soon. I’m certain that if that happens, a few trees and grass there would too vanish as if they never existed.

Moderation is gold, and all that.

It’s less efficient use of space, it should be more expensive.

No. The spaces with more density and better infrastructure have also bigger commercial demand, as offices, malls and such. Well, where I live we don’t have zoning laws, so maybe it’s different in your land of cowboys and coyotes, but I think rented apartments still fit the definition. And already developed places are more contested than empty areas. The function is quadratic, so in uncontested areas it’s commercially viable to own and support homes cheaper than renting. The expenses of living there come from transport, fuel, anything from food to matches to medicine being more expensive due to logistics (except probably for things produced nearby), worse connectivity, electricity outages, having to spend a lot of time to get to work.

Provided the supply isn’t artificially prevented from reaching the demand. Which is what, I’ve heard, your country does have as a problem.

and that the buyer’s housing costs won’t exceed 30% of their gross monthly income

That rule of thumb for how much to spend on housing is also a maximum, not a target.

Most of what American spending increases have gone to over past decades has been housing; the proportion of income we allocate to other things has declined as a share of income. A lot of that has gone to increasing the square footage of houses, while the number of people living in an average household has dropped significantly.

https://www.statista.com/statistics/529371/floor-area-size-new-single-family-homes-usa/

In 2023, the average size of a single-family home built for sale in the United States amounted to 2,514 square feet. Although in the past five years American homes have been shrinking, since 1975, they have almost doubled in size. This trend towards larger homes seems illogical given that the average size of families has shrunk over the same period.

Why are American homes so large?

Homes in the U.S. are among the largest in the world, only surpassed by Australia. There are thought to be several reasons for this, including the concentration of wealth in the country, and the deeply engrained driving culture which means that cheaper land outside city centers is easily accessible.

Where are the largest homes located?

The size of homes also varies regionally, with the largest homes being located in wealthy, urban areas and in the South. Large homes, or McMansions as they’re often called, are especially popular in Texas. In 2023, Milwaukee and Omaha had the largest average home size.

https://247wallst.com/special-report/2016/05/25/the-size-of-a-home-the-year-you-were-born/

In 1920:

Avg. floor area of a new single-family home: 1,048 sq ft

Avg. floor area per person: 242 sq ft

New homes started: 247,000

GDP per capita: $10,164In 2014:

Avg. floor area of a new single-family home: 2,657 sq ft

Avg. floor area per person: 1,046 sq ft

New homes started: 1.0 million

GDP per capita: $55,762https://cepr.net/publications/in-the-good-old-days-one-fourth-of-income-went-to-food/

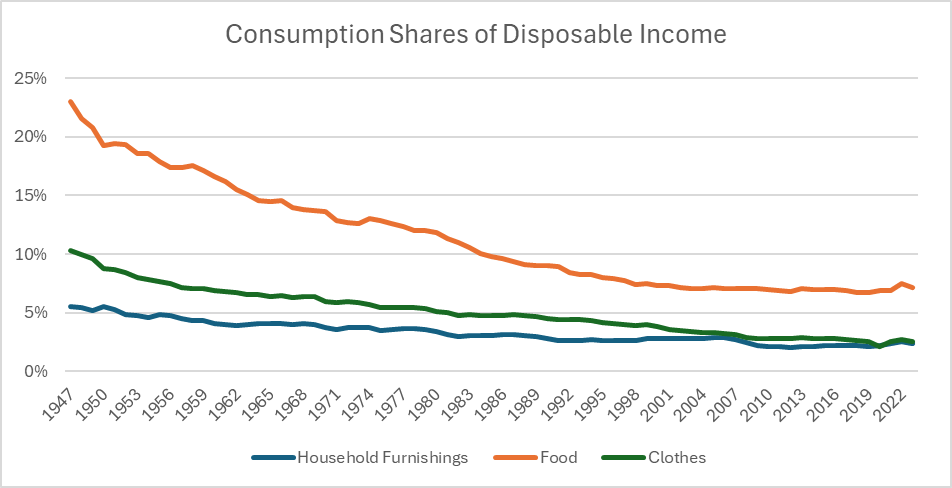

It is certainly true that we are spending a much larger share of our income on housing than in prior decades, but a big part of that story is that we are spending a much smaller share on other things. The graph below shows the share of disposable income going to food, clothes, and household furnishings since the late 1940s.

As can be seen, there has been a sharp reduction in the shares of all three. This is especially striking with food. In 1947 we spent 23.0 percent of our income on store-bought food. This had fallen to just 7.1 percent last year. The share of income going to buy clothes fell from 10.3 percent to 2.6 percent. The share for buying household furnishings dropped from 5.5 percent to 2.5 percent.

These declines freed up income to go to other areas, and one area that extra income went to was housing. The houses we live in today are on average much larger than the ones we lived in 75 years ago. They are also far more likely to have air conditioning and relatively clean sources of heat. (Coal furnaces were still common in the late 1940s.) They are much better protected against fires and less likely to have harmful chemicals like asbestos and lead.

As a result of reduced spending in other areas, and the higher quality of the housing we live in today, the share of our income going to housing now exceeds 34.0 percent, on average. (This figure includes “owner equivalent rent,” the money that a homeowner would be paying to rent the home they live in.)

Around the global financial crisis, there was a bit of a fad for tiny houses:

https://en.wikipedia.org/wiki/Tiny-house_movement

One definition, according to the International Residential Code, a tiny house’s floorspace is no larger than 400 square feet (37 m2).[8][9] In common language a tiny house and related movement can be larger than 400 ft² and Merriam-Webster says they can be up to 500 ft².

While I think that some of that goes a bit over the top, it does provide some perspective; if one person lived alone in such a 500 ft² “tiny house”, even that would be more than double the per-capita square footage that we had in 1920.

To use one example, Elon Musk lives in a 400 ft² prefab after he got into the tiny house thing.

I’m not saying that there aren’t reasons for that. We have air conditioning in 2025, and didn’t in 1920. In 1920, people have might have gone outside for a lot of the time that today, they’d spend inside. We have a lot of appliances and stuff that we didn’t in 1920, and if one wants an electric dryer and washing machine and that sort of thing, it’s gotta go somewhere. But I think that being aware of that is useful to understand where a lot of increases in wealth over time went — in large part, into living in larger, more-elaborate housing.

Even if you compare current US to current other countries, we have pretty large houses.

https://shrinkthatfootprint.com/how-big-is-a-house/

Are those sizes including non houses as houses? How do you make a 484sqft HOUSE???

They’re houses (or in Hong Kong’s case, probably apartments).

The “Tiny-house movement” Wikipedia page that I linked to above has some pictures if you’re talking about stand-alone rather than multi-unit buildings.

I didn’t read your whole post but regarding the home size increase, I think part of this is due to the invention of engineered trusses allowing builders to build bigger homes with less wood and less wasted space.

in the US more affordable options are priced or regulated out of existence such as trailers and with gentrification even the cheapest housing would not be covered under most jobs including teacher salaries

plumbers and other construction workers even with experience may only get $15 hour or less and that is common here too

another trend popping up here is no living in hotels with the max being 30 days total in a year

and homelessness is illegal in a lot of places here as well so the end goal has to be more slave prison labor and a better controlled population

Where are you in the US that plumbers and construction get paid less than most fast food places? I’m in a red and rural area and plumbers here are pulling in 90-100k starting and construction is starting around $25 an hour now. Trade skills make money.

I’m in a red and rural area and plumbers here are pulling in 90-100k starting

If accurate, I would say that that is probably not very reflective of the national situation.

https://www.servicetitan.com/blog/plumber-salary

For entry-level plumbers, the median annual base salary is $52,000, or $25 per hour.

For intermediate plumbers with 2-4 years of experience, the national average rises to $67,600, or $32.50 per hour.

At the senior level, defined as 4-6 years of experience, the average is $73,200, or $35.19 per hour.

There’s also a per-state breakdown, which doesn’t show dramatic variation.

where are you? travel all over the US

the owners make bank maybe but not the plumbers hired on to alleviate the workload

I’m in the south, and I have friends who work for these companies and even run their own. There is a difference if you’re not licensed though, but even then they’re not making just $15 or less an hour.

agree but those people talking about are probably over 40

younger people licensed or not are being shafted when it comes to pay and treated like expendables

one of those plumbers know eventually gave up plumbing and he was damn good

I have several friends who are electricians / carpenters / roofers / contractors. They all tend to work about 6 months out of the year, make bank, and then spend the winter travelling. They could work more if they wanted to, but they just don’t want to, and know they can pick up work basically anytime they want. One electrician friend of mine lives in a small town and is working on forming his own business (which would employ only him), and expects that he will out-earn his wife, who is a physician’s assistant, if he chose to work full time.

Homeownership

I expected English from the AP. Is that now a bridge too far?