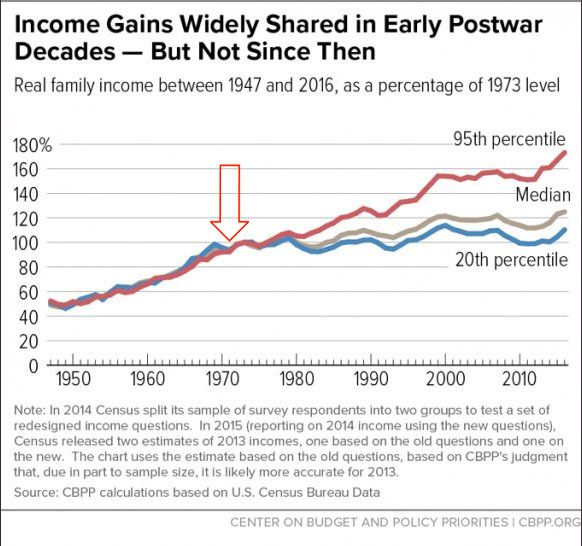

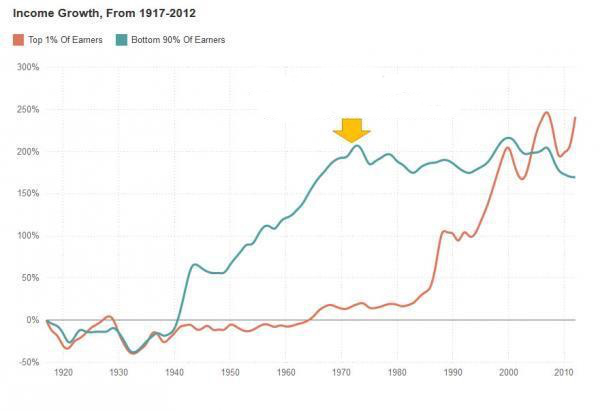

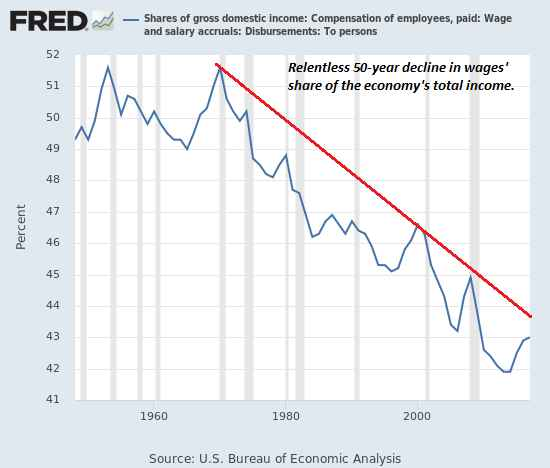

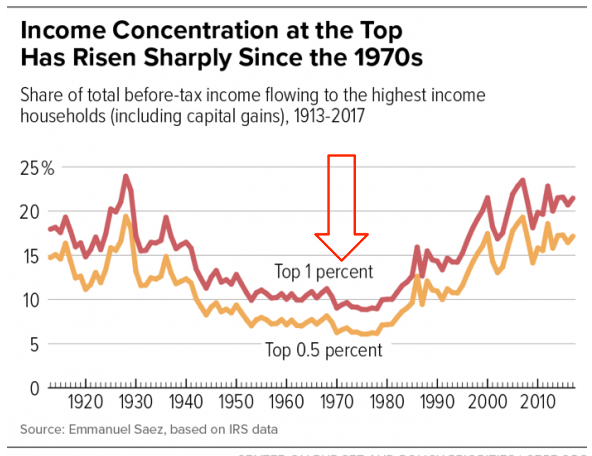

Some of my favorite charts:

more

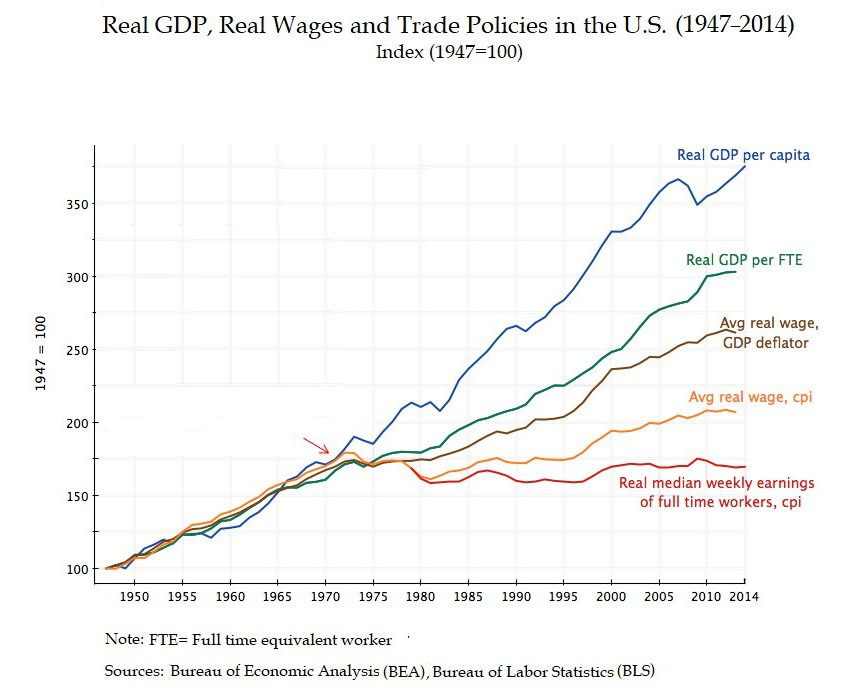

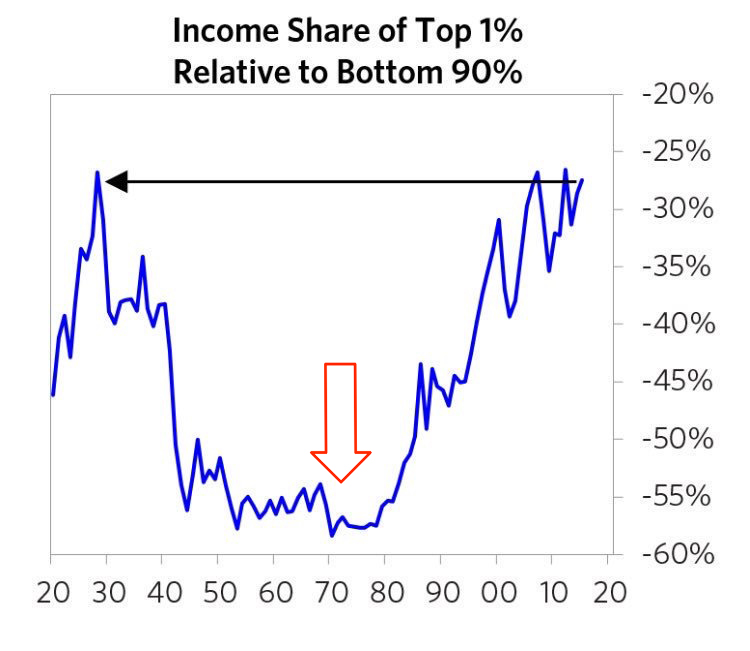

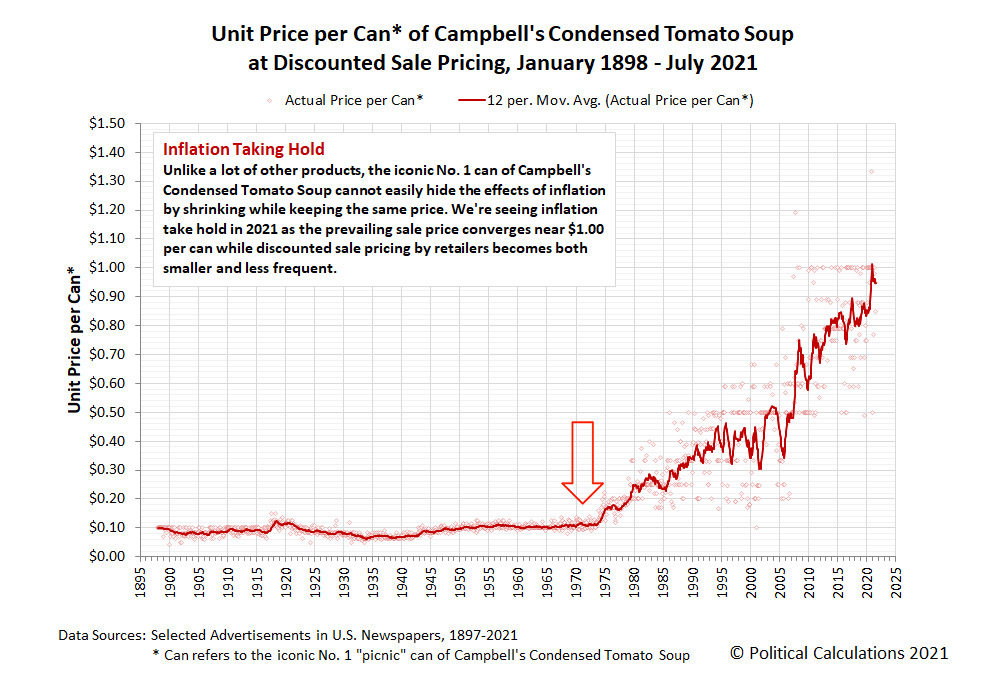

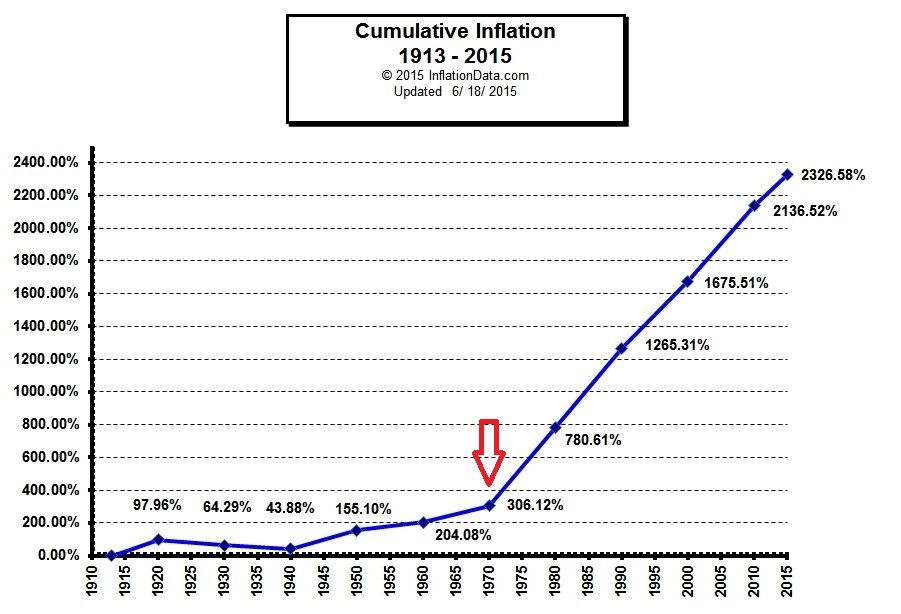

Has someone been reading https://wtfhappenedin1971.com/?

Does this website answer this question?

What was that event in the 70s that all the arrows are pointing at?

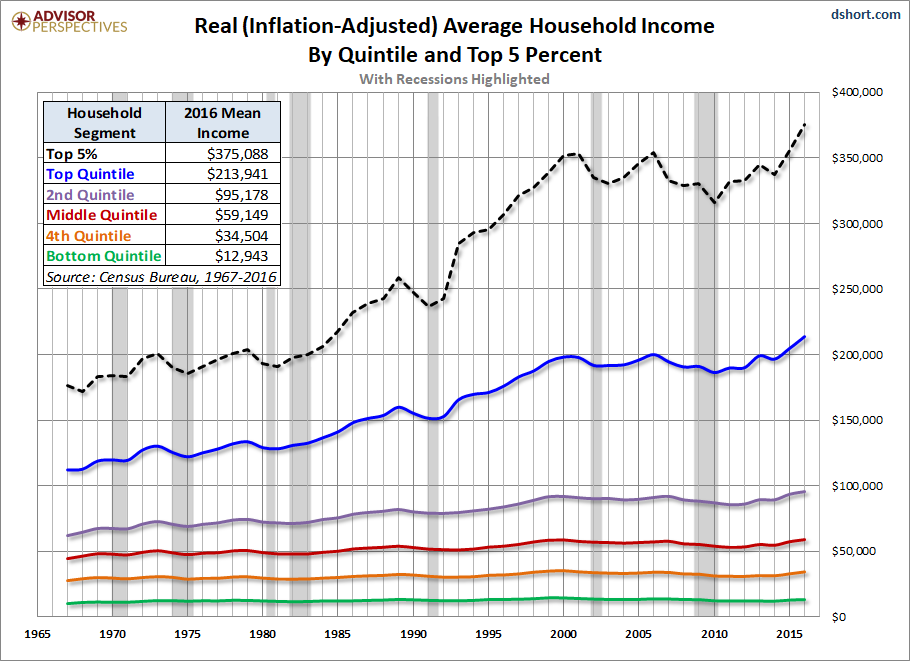

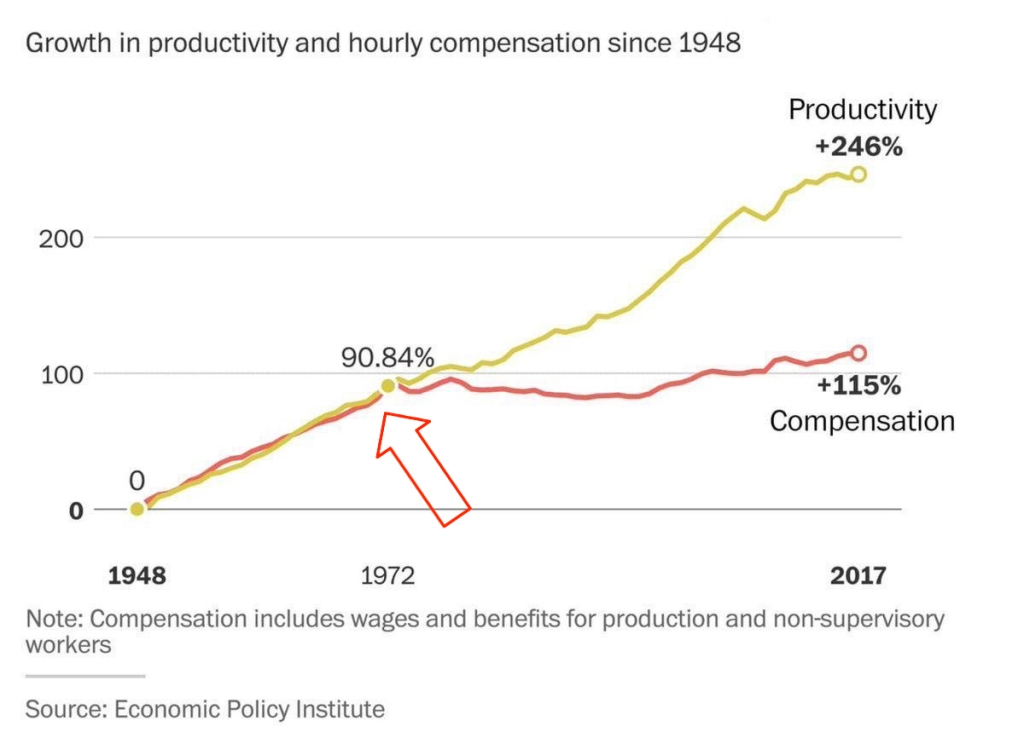

The money system changed so that the bottom 80-90%'s wealth and income is constantly lowered via inflation and that stolen money is then handed over to the richest and most powerful people/companies via debt.

(side note: when I’m saying wages or wealth are shrinking, I mean in real terms, meaning adjusted for inflation, since the money you do get paid is worth less each year)

In this new system Nixon set up, new money is created out of nothing via debt via the banks, that money first mostly goes to the largest companies as loans. The Cantillon Effect describes how these companies can use that money before the inflation from the distribution of that money kicks in.

So not only is it stolen money, it’s also worth more if you sit right at the tap close to the banks and the central banks.

But the biggest effect is that the working class can’t adjust their wage prices as fast as companies can adjust their prices, so they are constantly shrinking compared to corporate profits. only the top income earners can outgrow the devaluation of their income (e.g. tech workers).

As an example, this means Amazon gets the wealth out of your pockets and on top of that profits off of the fact that their workers wages are constantly shrinking in real terms.

Another difference is the one of the working class’s most important way to store wealth is through savings which are inflated away constantly, vs the rich have the ability to invest in a way doesn’t get inflated away.

Another issue is interest rate manipulation, specifically artificially low interest rates. It floods the market with money, preferentially going to already wealthy people since they have an easier time getting loans and bigger ones. This mainly creates a giant bubble in the real estate market, making everything more expensive than “natural”. So anyone with real estate gets richer and richer and everyone else gets screwed over. That’s another reason why the rich get richer and the poor get poorer.

Inflation also constantly devalues debt, so the rich that hold the most debt are effectively getting their debt paid off via the wealth of the working class.

In this system, anyone who can profit from debt and outgrow inflation wins and everyone else looses big time. Practically that means the bottom 80-90% of society.

Then also global labor arbitrage screwed over workers, so outsourcing.

The groundwork for this system was created in 1971. Some of this has been set up later. It was a takeover of our monetary system by crony capitalists to rig it in their favor.

There were a bunch of other policy changes disadvantaging the working class that others argue are more important, but in my opinion the changes to the monerary system are by far the most important effect.

That system has been cloned all over the world, that’s why everyone has the same issues.

Another issue is that per capita energy production has been stagnant since 1971, energy correlated almost 1:1 with wealth. But that’s at least for a good reason, that being to protect the environment. Still, not only are we not growing richer (besides from efficiency gains), a larger and larger share of what wealth we do have is going to the rich.

If we want to reverse that we need to constitutionally enshrine stable money (i.e. no inflation).

You could also try to redistribute the new money created via inflation to the working class somehow, but that seems silly when you could just have stable money instead. Imagine if you could just build wealth by just saving money again.

Or you could force companies to adjust wages by inflation, but that assumes we can produce accurate inflation numbers. In reality the official inflation numbers are always lower than the real inflation, so workers would still be screwed over. So I’m still for stable money instead.

And unless you want to wait decades to get back the wealth that has been stolen over the last 50 years, you need to redistribute it back to the bottom 80-90% in some way.

For example you could do a 8% wealth tax. The stock market grows by 8-10% each year, meaning if you have money, you just get 8-10% richer each year by literally doing nothing. If you take away that, the playing field is leveled with the working class. it basically means the rich would actually have to work for their money for a change.

We have to change something, because the system is clearly at the breaking point. Economic and well-being indicators haven’t been this bad since WW2. And in may cases they are worse.

We are basically just serfs who only exist to make the rich richer at this point.

Give out new money as UBI rather than as loans to banks :D

Nixon i believe.

Not Reagan?

Reagan was 81-89

odds are, if it’s not Reagan then it’s either Nixon or Wilson.

The end of the gold standard in 1971

I think it’s the end of the gold standard

Thanks

This is far better than the op.

Nope. Rich people are making more money than ever while our economy is “bad” at the moment.

Yeah the OP is incorrect. When the economy is doing well it means that regular people have some chance of ekeing out a living. When the economy is doing bad it means only the wealthy are doing okay.

This makes more sense than “rich people doing better than ever” during a down economy.

I rememer learning in macroeconomics even wealth distribution was critical and that a disparity like what we see today is on the precipice of civilization collapse. Now some of our capitalists acknowledge this and note we need to let the government regulate markets for sake of the public, but the majority of billionaires are like nah.

This is probably the best example I’ve seen of “let them think you’re an idiot, rather than open your mouth and remove all doubt”.

A. Rude

B. Shawn Fain said basically the same thing during an interview about how striking “hurts the economy”

https://youtu.be/e1RUDd3e0kI?si=RyJlcH_b4T9RTlNg

If the economy doesn’t work for everyone, then I say fuck it

People tend to scoff and tell me to grow up when I say it, but it’s so critical and fundamental… The economy is made up.

All of the “rules” all of the metrics are arbitrary, and usually governments and rich people choose the ones which benefits them most to believe

Food is real. Houses are real. There’s enough for everyone. Maybe, just maybe, we can stop running statistics and making bets on mathematical abstractions on top of abstractions on top of an arbitrary system of abstracting value. Trading stock or investing isn’t actually work, it doesn’t create or change anything, it doesn’t actually do anything for humanity. It’s basically just gambling. Why is it the most profitable behavior in our system? Why are devoting so much of our resources towards it?

I’m utterly convinced AI is going to expose the fallacy of these systems soon. Once everyone has the world’s greatest stock trader in their pocket - once everyone is winning, what’s the point anymore?

Monopoly money

That’s assuming you have money to put into stock. Most people are either living paycheck to paycheck or save pennies (relatively speaking), they don’t have anything to invest. AI won’t magically give people money to invest.

Also a great example of people who don’t have very good reading comprehension here in the comments.

Is this about me?

Rich generally do pretty fine for themselves when the “economy” tanks.

Just look at how much richer they got during the COVID recession lol

Really depends on the industry.

Ya for the majority it won’t make a difference, but the working class will certainly still feel some crunch through job security or cost of living. From this perspective whether the economy is doing well or not is more a top 50% thing than 1% thing.

It will make a difference, though. When the economy is bad, the rate at which our lives get worse accelerates. When the economy improces, we go back to slowly getting more fucked.

When my company stock started to slide during the pandemic, I lost literally hundreds of dollars. I wasn’t overly concerned about my loss. Not because I’m rich by any measure, but because with that big a slide, the rich were going to taste it in their ass holes. And that felt pretty good.

Unfortunately, they probably didn’t feel it at all.

They could live off their fortunes for 1000 years without ever slipping into “middle class” so a few years of slower profits wouldn’t have any real effect on their day to day lives.

Getting upset that their wealth isn’t accumulating fast enough is also their natural state of being – before, during and after COVID. If they weren’t throwing tantrums because people weren’t willing to die a gasping, terrified death in the name of corporate profits, they would have been throwing a tantrum because they weren’t allowed to pay children half the minimum wage to mine national parks.

And of course, they come out the other side with even more leverage. Thousands of cafes and restaurants went out of business, but Starbucks and McDonald’s didn’t. The shortages and scalping made companies realise they could have been squeezing people even harder, a mistake they seem determined to never make again.

Pandemics aren’t the solution, prising neoliberals out of positions of power is.

In terms of money being put into the economy or just GDP? Wouldn’t a good economy mean a thriving middle class to stimulate it rather than the rich hoarding all the money they can?

It used to be like that. Give money to the middle and lower class and have the wealth trickle up to the wealthy.

The money still comes from the middle and lower class but now it’s just through giving our tax money directly to them. No need to build pesky businesses and have to deal with that headache. How gauche !

I don’t disagree 👍 Eat the rich

The best time to invest is when the economy is down, that’s how they grow more money off of the misfortune of the commoner

That’s why I don’t give a shit about the “Economy”. It’s like Aliens vs Predator, whoever wins I lose.

What really matters is that shelter, food and basic necessities is put into the hands of those who need it and no one is discussing how best to do that.

This is just not true but I bet it sounds very deep to you

Ok Bezos.

OP are you 14? Yes wealth inequality is bad but that doesn’t mean the economy is completely decoupled from the average person’s quality of life.

Oh it is. When economy good, everything gets more expensive. When economy bad, everything gets more expensive.

Everything else is irrelevant.