Key Points

- As shoppers await price cuts, retailers like Home Depot say their prices have stabilized and some national consumer brands have paused price increases or announced more modest ones.

- Yet some industry watchers predict deflation for food at home later this year.

- Falling prices could bring new challenges for retailers, such as pressure to drive more volume or look for ways to cover fixed costs, such as higher employee wages.

Retailers fear things that would help consumers consume? Sounds like retailers don’t know how to succeed without gouging.

The last time USA had extended deflation, the Great Depression happened. When people stop consuming, retailers fire their workers. Then fewer people can consume, so more people get fired. This goes on enough, then its not just stores who fire workers, but it trickles to factories, R&D, office workers, etc. etc. The longer deflation happens, the further it spreads and the more people lose their jobs.

Ever since the Great Depression happened, US Policy has been strongly anti-deflation. Our policy is to “err” on the side of slight inflation.

So what happens when retail workers don’t get paid enough to consume even with jobs?

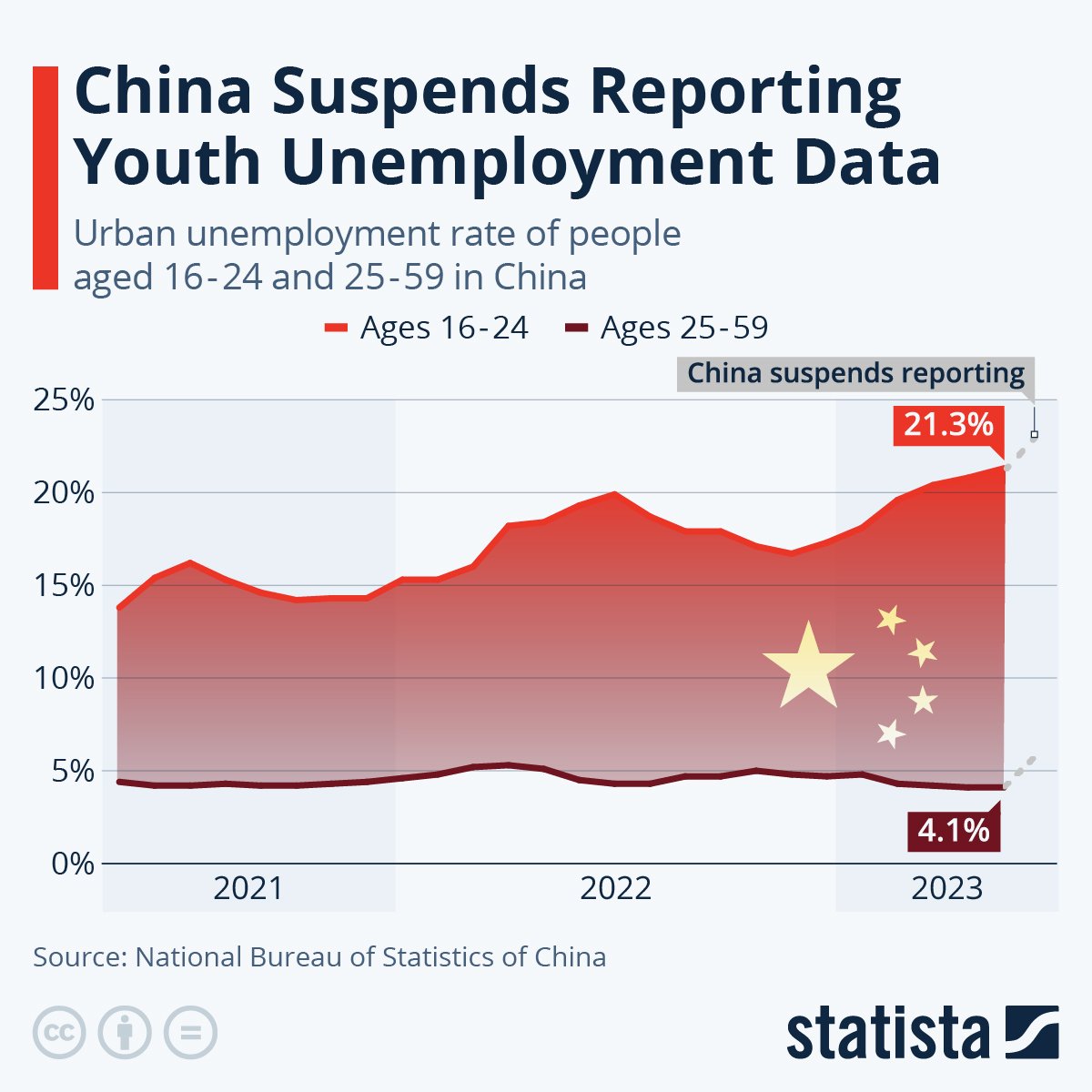

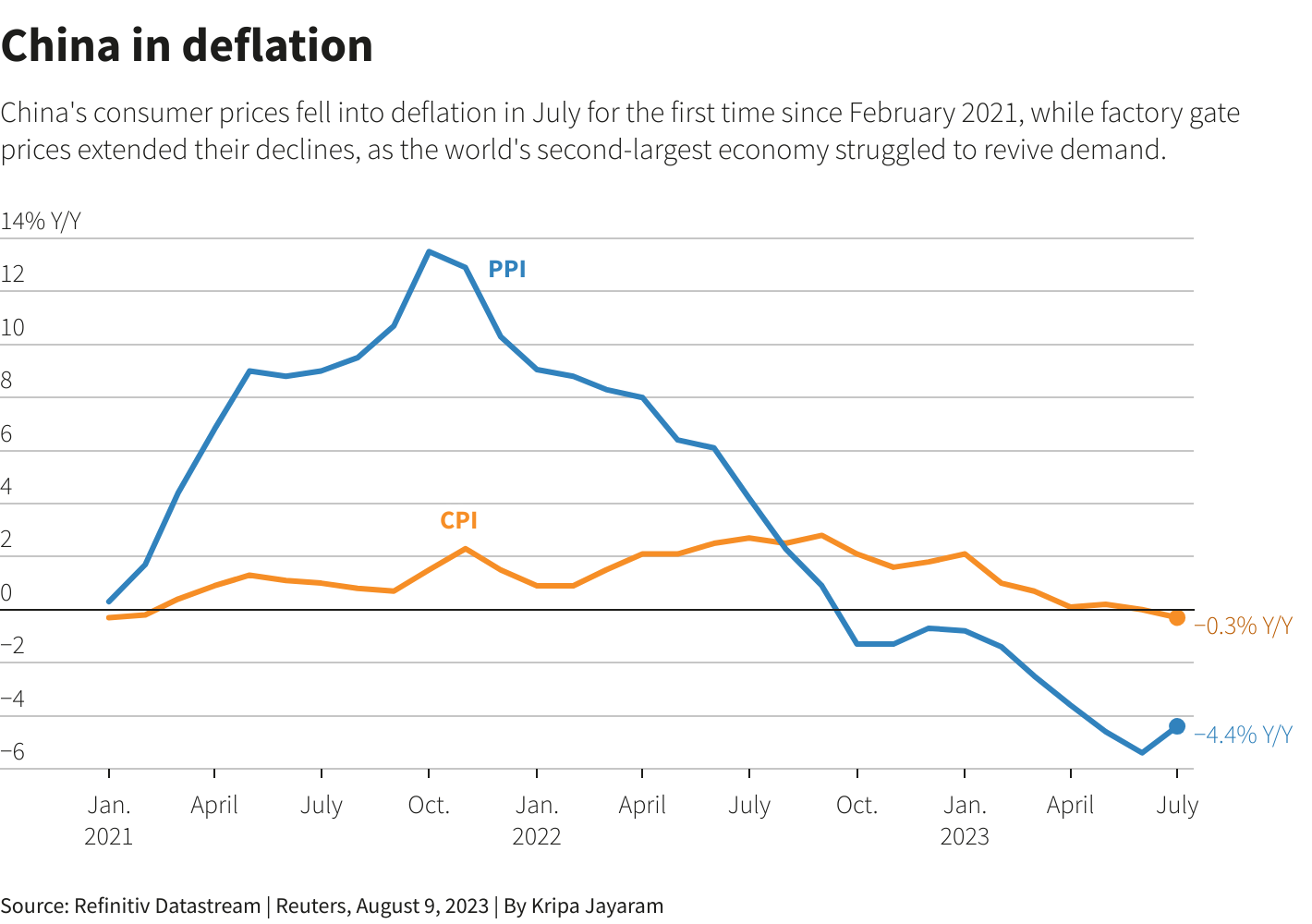

Prices drop, causing more people to get fired. IE: The Great Depression. Or if you want a modern economy that’s undergoing this shift, just look at China right now.

If people can’t afford things, your only choice is to fire workers and drop prices further. That’s just economics. (Why do you need workers? No one is buying anything, so fire your workers. Duh). The more people realize that this is the only strategy to survive, the lower prices get, the more people get fired, and the less that people can consume. It gets worse and worse until economists change policy and pull you out of this.

This is why we have large pseudo-government central banks keeping watch over our economy. Deflation cannot be tolerated. Yes, inflation sucks, but at least people still have jobs and livelyhoods in times of inflation or hyperinflation even. That’s actually survivable. Deflation is NOT survivable, it sucks so much worse. Deflation is all-hands-on-deck we need to work together kind of situation. We never want to push the economy to that direction.

China isn’t doomed btw. China’s plan is to exports goods to Europe and hope that Europe buys enough Chinese crap that they can kickstart demand again. And as prices drop further and further, Chinese goods will get cheaper, and crap like Temu will pop up to sell these cheaper goods to everyone. Now there’s geopolitical repercussions to this (not everyone will want to support such “dumping” of goods into our countries), so there’s no guarantee that China will be successful on this front.

In that case tie minimum wage to inflation so no matter how bad inflation gets the poorest don’t lose their shirts (and stop consuming)

Oh, so in times of deflation you want minimum wages to drop automatically? Deflation is “negative inflation”. I’m talking about the inverse scenario compared to what you’re talking about. Sorry, that sounds like a terrible idea.

And unfortunately for your argument… despite the high amount of inflation in 2022 and 2023, consuming rose dramatically. Or did you forget how ridiculously overpriced everything got, all those shoes / collectables people bought and the stock market skyrocketing as too much money was flooding the markets?

That’s called an “overheated economy”, too many people did too well during the times of inflation. That’s… kind of the problem. Inflation happens when lots of people make more money.

IE: Emperically speaking, we can just look at the results of the last ~3 years of the USA’s economy. Consuming went up with inflation, just as expected. There’s no need to “encourage” consuming during inflationary bubbles.

In fact, what got inflation under control was the huge amounts of +Interest Rates encouraged by the FFR. Did you not notice the dramatically higher credit card rates that are cutting into people’s budgets? That’s almost by design, increasing the FFR increases all loan costs (house mortgages, credit card bills, and car loans). That’s how we fix inflation, by kind of destroying money / taking money away from people.

We should have increased taxes instead IMO, so that our budget could have been managed better. But whatever, inflationary-bubbles are caused by over-consumption. The goal when inflation/hyperinflation is occurring is to cut back on consuming, and you discourage that by doing policies that are deflationary in nature.

IE: The Fed is currently slamming on the brakes (ie: doing policies that risk a deflation right now), to cut back on the chances of inflation. That’s why retailers are scared, they’re worried that the Fed is pumping the brakes too hard / increasing interest rates too much right now.

So should wages for poor people ever go up, in your opinion?

What’s your opinion on legislation that would tie wages to their ROI for the business?

Edit: Why not force large corporations to pay their CEOs less so they can raise wages for their employees while keeping prices the same? It seems like you/economists realize corporations will let the country go to shit while stealing as much of the profit as possible and prefer that average workers deal with the detrimental impacts.

So should wages for poor people ever go up, in your opinion?

More like wages are kind of irrelevant from a macroeconomic perspective. Money doesn’t matter. We can double our money supply tomorrow and it won’t make anyone’s lives easier.

See Argentina’s minimum wage, and tell me if that solved any problem at all.

But… if increasing the minimum wage makes you feel better I’m not against it. I just don’t think its the right focus to have on a policy front.

What’s your opinion on legislation that would tie wages to their ROI for the business?

That sounds like a good way to kill innovation, as most companies that innovate lose money year-over-year for long periods of time.

The entire damn point of the stock market is to take people who like to take risks with their money (ie: investors), give them a story about how money line goes up, and “trick” investors into shoveling money into money-losing businesses until those businesses catch a good wind and make money.

In many cases (ie: MoviePass), everything collapses and everything sucks afterwards. In other cases (ie: Netflix, Amazon, Microsoft, Apple), life gets better in the long term. Its near impossible to tell the difference (do you think Uber is going to collapse? Or do you think Uber will become another major player of our economy? Do you think NVDA deserves all the extra money they got last week? Or is that a bubble?). But the important thing is that the USA has a large group of shareholders and investors who like making such risks, and who take the responsibility (ex: lose tons of money) if these bets go sour.

The goal is for us as an overall economy to make new things, and improve the lives of everyone. Money strangely enough, doesn’t do that. We improve the lives of everyone by producing more, thereby giving everyone more dishwashers, homes, cars or whatever they need.

The big problem with the current “economy” isn’t anything in general. USA’s general economy is actually very good and people should be proud of what USA has accomplished in the past 3 years. The reasons why life sucks are outside of what economic forces can do. Ex: Housing prices skyrocket because we’ve been building fewer and fewer houses each year for the last 20 years.

https://fred.stlouisfed.org/series/HOUST

This is despite population growing more-and-more.

https://fred.stlouisfed.org/series/SPPOPGROWUSA

So guess what happens when housing supply drops while population increases? No one can afford a house, and there’s no economic policy you can do to force people into buying houses (ex: increasing wages) because there’s simply not enough houses in our country.

Until we build more houses, we ain’t gonna get more affordable houses (at any wage). The focus on money is counter-productive. The focus needs to be on houses or other goods/services in the economy. (Ex: not enough nurses, not enough doctors, not enough etc. etc. etc.)

Investors/shareholders risking their own money to make new services, new goods, new technologies is fine. That’s the part of our economy that works. The problem is that we’ve got a $HundredBillion plowing into crap companies that won’t do anything ever… but somehow somewhere our economy has forgotten the basics like housing starts. Maybe its regulatory (too many NIMBY laws that outlaw cheap housing), or something. But we have the investor-money, we have the culture, we have the materials. We just need to actually build the damn houses.

One issue with raising taxes as a tactic for slowing money supply growth is that it is not very agile. Once inflation gets back under control, Congress is not automatically going to lower the tax rate. I do agree that we should raise taxes but that’s more for four the budget deficit and the high wealth inequality.

Removed by mod

Imagine if China made “goods” instead of shit.

China has a lead on US manufacturing in a number of areas. I mean beyond just labor.

Apple iPhone motherboards and assembly is in China and I think everyone agrees its a very high quality phone. Its no cheap PCB either, but a relatively advanced 10+ layer board with a huge number of chips, components. With volumes that no US company can sustain.

We need to learn from China, but we also need to avoid the absolute crap / bullshit / economic failures of China while doing so.

There’s nothing to learn from China. They “learned” their manufacturing base from the US, when the wealthy leveraged trade deals to make production as cheap as possible. China has no equivalent to OSHA, doesn’t value human life or safety standards, and has weak environmental regulations in comparison to the US. The US has incredible potential especially as automation gets leveraged but we’re forever hamstrung by our bullshit economics and “line go up for shareholders” system thanks to our corrupt politicians. We have nothing to learn from China except that totalitarian states are worse than our oligarchs.

In fairness, the reason garbage comes from China’s factories is the US corporations that place orders for consumerist trash. My subtle point was, imagine if China’s “customers” valued quality over cheap production. Ever heard of Chinesium?

Ever heard of Chinesium?

You ever hear of the iPhone?

They “learned” their manufacturing base from the US,

You ever hear of Shenzhen? Its a city for electronics in China. Its completely different from anything available in the USA, believe me I’ve looked.

You might want to look at China again. https://www.youtube.com/watch?v=uq_aeq2NTVE

The US has incredible potential especially as automation gets leveraged

China is incredibly automated. A ton of heavy machinery / automation is made in China. See JLCPCB youtube link above.

https://www.youtube.com/watch?v=h1IpTtRV9Sg

You think China doesn’t know how to use machines to automatically make pcb boards? Do you think a human actually was placing every single component in an iPhone?

The reason why Shenzen can create items cheaper than USA is because they have a larger volume, larger scale, more automation and superior logistics. Its time for us to learn the basics from China again. Even in China, you ain’t gonna get technicians or electrical engineers who can use these manufacturing lines at minimum wage. These are highly skilled workers, in a city full of EEs sharing knowledge and working together.

Apple chose China as a manufacturing site not because it was cheaper, but because it was higher quality and more flexible than the USA supply lines. That was over 15 years ago. People need to wake up to the manufacturing beast that China has become.

That being said, Chinese economic policy remains utter shit. So we still can pull ahead of them. But China’s out-automating us and has cheaper labor. Legions of pick-and-place machines, CNC Mills, 3d printers, pcb soldering… (enough to mass produce the iPhone) all exists in China.

Automation? China’s got more pick-and-place machines, they got more soldering ovens, they got more stencil masks than us. We need to start catching up to them.

USA has the advantage in energy though. So whatever automation we make here in the USA will be cheaper due to our cheaper energy. China still relies upon importing from Russia and other countries, while USA is largely self-sufficient for energy.

We’re only at risk for people stopping food consumption if prices don’t fuckin fix themselves, and I’m serious about that. People are gonna eat if they can eat.

COVID19 saw massive declines in food consumption, to the point where milk was dumped, pigs were slaughtered, chickens were culled.

US Policy under such times is to keep producing high amounts of food to ensure our food security and fund the dumping of milk, pigs, chickens, etc. etc. It takes years to grow an animal for slaughter, if we didn’t do that we would have had not enough meat as we came out of COVID19.

So much of our economy worked because we have policies and watchdogs thinking about economic policies. This sort of shit is invisible to the typical citizen, but is key to why our country came out on top, while others did not.

We still had a big blip in egg prices on the reverse end as we came out of COVID19 and people wanted fancier foods again. But we normalized pretty quickly in the great scheme of things, and our policy to explicitly waste food during recessionary times / deflationary times (like COVID19) was key to making sure our production pipeline remained full, and that our food supply remained secure.

https://www.nytimes.com/2020/05/14/business/coronavirus-farmers-killing-pigs.html

These are dark days on many American pig farms. Coronavirus outbreaks at meatpacking plants across the Midwest have created a backlog of pigs that are ready for slaughter but have nowhere to go. Hundreds of thousands of pigs have grown too large to be slaughtered commercially, forcing farmers to kill them and dispose of their carcasses without processing them into food.

People will stop consuming meat if I dunno… meatpacking plants are full of COVID19 sickness and no one packs any meat. The pigs get shot / burried instead and the end-consumer goes without pork for a bit. This literally just happened a few years ago, so I’m surprised people don’t remember this…

We literally staved off an apocalyptic economic event through shear determination. We should be more proud of our accomplishment.

Eating meat doesn’t mean people aren’t eating though.

We didn’t eat that pork.

We shot those pigs and then buried them and left them to rot. No one got that meat.

Then a bunch of idiots who can’t read basic statistics complain about inflation and the rising cost of meat a few months / years later.

That’s the ‘Transitory’ argument to inflation. That the meat was a temporary blip. Fortunately (???) I think it turns out that other bits of inflation ended up being real so the 5.25% rate hike remained a good idea. But the meat and eggs inflation was likely a direct result of our COVID-19 emergency plans.

People will stop consuming meat if dunno. meatpacking plants are full of COVID19 sickness and no one packs any meat.

That’s not about prices being too high. It’s about people being too sick to do the work…

We are not at risk for any sort of sustained deflation. Inflation is currently over 3% (higher than the Fed’s target of 2%) and interest rates are very high. We have a lot of wiggle room if inflation starts dropping.

The cause of the great depression was overextended credit and stock market gambling. Deflation was present because people didn’t have as much money (or credit) to spend, but it was merely a symptom of an economic downturn, not the cause.

The cause of the great depression was overextended credit and stock market gambling

If the Great Depression happened during COVID19 (2020), then we’d still be in the middle of it today (2024) and wouldn’t really be out of it until 2028.

The Great Depression started in 1929. It was exacerbated by terrible economic policies and continued to get worse until 8 years better, when finally new policies kicked in and brought us out of it.

The Deflationary spiral was a big part of the extended depression and the multi-year effects. This deflationary spiral was stopped by making gold illegal, allowing the USA to float its currency more arbitrarily (ie: forcibly cause inflationary effects to counter-act the deflationary spiral).

Between 1930 and 1933, 30% of money was wiped out. That’s a deflationary spiral by any measure. As money became more expensive, everyone in debt (ie: credit cards today) would be worse.

If you owed $100 in 1930, you effectively owed $130 in 1933, because all money got more valuable ($100 in 1933 was like having $130 in 1930). Imagine if that happened today: that everyone’s student loan debts, mortgages, and other debts just suddenly became more valuable nominally. It’d be horrific and extend the problem.

We only got out of the great depression because of world war 2. Any policy pales in comparison. It was a huge government spending program that employed many. It also meant a lot of working age men died, shrinking the labor pool, thus putting upward pressure on wages. The generous social programs helped, as did the fact that US infrastructure wasn’t destroyed like it was in Europe.

We currently have a high base interest rate set by the fed. The country can fight deflation easily by cutting the rate from its 5 base points, which will increase lending and spending

This shouldn’t be an issue now.

The debate is whether to cut the FFR yet.

I’m against it. But people are rightfully worried about deflation. Its a terrifying situation from an economic point of view.

But you’re right. There’s very little sign of deflation (yet). We can hold rates higher, and maybe even go another +.25% up. Inflation is at a safe level right now, not too high and not too low, but we need to stay on guard to make sure it stays in this golden zone, and move as appropriate.

There were too many new jobs (too little unemployment) again in January. So we might still have rates too low IMO.

Line go up….this quarter, or else.

You’d think it would help consumers consume, but if deflation is too steep and too extended people start rationing as much as they can because they don’t want to look like an idiot for buying that gallon of milk this week instead of next when it’ll cost half as much.

Yes, I’ll skip eating this week to save $50

OR, hear me out, I’ll just spend the money because I’m hungry

Funny way to spell “I didn’t read the comment before I replied” but ok buddy.

No really food is not a good example. People will always need to eat so you’re presenting a scenario where everyone has so much access to food and money that they can choose to forego some of it to enrich themselves. It will take a lot more than that to scare people. The idea that everyone will suddenly turn their backs on this consumer culture we’re living in is not keeping me up at night either.

Traditional economic theory- yes. Hence why deflation can cause such issues.

However, there is also a significant part of consumption that you will make regardless of price, because the alternative is death. (C0 and C1 for anyone who took first year).

The problem is prices grew soo much our entire spending is now limited to essentials (c0), and even if I knew it would be cheaper next week im only getting it because I need it now.

Why would the price of milk drop by half? I’ve seen the price of eggs drop by half, but only after they rapidly jacked it up 6x and the price drop didn’t only take a week to happen. Regardless, if people are not going to be kicking themselves because they could’ve saved $2 if they bought a week later. It’s the collective raising of prices of almost everything altogether that is destructive.

This is an over-simplification, but consider this:

A farm has to sell their produce/livestock below their cost-price, because demand has dropped and the resulting over-supply has caused a race to the bottom as producers try to recoup as must value as possible.

This leads to less funds available to produce the next round of crops (further negatively impacted by economies of scale), cover operating expenses and pay staff wages.

People lose their jobs and livelihoods, causing a negative feedback loop resulting in less demand overall… repeating the cycle. The Great Depression of a century ago was an example of a similar scenario.

How’s this for an over simplification: we should find the guy who got the big bag of money that started the whole thing open that bag.

Inflation is a funny word for “price gouging.”

Right?

Like… It’s not some great mystery. We see inflation at 5% and prices go up 8, 10…15%…and the companies say it’s because inflation.

I am a private music teacher, and while most private teachers will go through a school to do lessons, I’ve just gone freelance and do it all myself. I get to set prices and recruit or not and I have so much freedom, but one thing I found was that in setting prices, people will pay what you say. If they can’t I’ll chat a bit to see what the situation is and see where I can make discounts of course, but wealthy families are willing to do $100 an hour easy. I know I could bump it to $150 for some.

Basically all I’m saying is inflation is BS for companies making up higher prices.

That’s the weirdest comparison you could make. Private teaching isn’t a necessity, even more so music. People aren’t picking between store brand music lessons and locally sourced organic free range lessons of higher quality because budget constraints.

Add to it. People don’t haggle. If you state a price and they’re fine with it? Then you priced it within their expectations.

No we are tired of price gouging by corporations. They’re fucking price fixing.

Yeah it really seemed like the crypto rush is what set all this off, but that can’t be right can it?

No. It was the pandemic and price gouging during the pandemic. The only thing crypto affected was video cards.

Correct. That can’t be right.

This article makes me want to vomit. All these companies and CEOs talking about inflation like it’s this intangible phantom that nobody can get a grasp on.

“If one looks at inflation over time, we very rarely get into periods of sustained deflation. That’s just not a consumer effect,” Coke CEO James Quincey said Feb. 13."

It’s the companies and CEOs price gouging. Call a spade a spade for Christ’s sake.

They’re incapable of sincerity.

Uh, it is?

Even massive companies like coke don’t control the entire economy and the respective levers we use to control inflation. A bottle of coke going up doesn’t cause inflation especially in our global economy.

About the only thing outside of government that’s big enough is OPEC, and we know they don’t have to do shit about anyone else.

The absolute price of coca-cola in the the United States has gone from $0.05 in 1970 to $2.69 in 2023. That’s an absolute increase of $2.64, or 5280% in a period of 53 years.

…

When we adjust for inflation, we see that the price of coca-cola also peaked in 2023, when it cost $2.83 (in today’s money), and was at its lowest in 1970 when it sold for $0.42.

The biggest drop in adjusted price happened in 2015, when the inflation-adjusted price dropped by $-2.37 (-100%). Even when adjusting for inflation, the biggest price increase of coca-cola was still in 2022. However, the $0.64 jump actually felt like $0.64 to the consumer due, to the effect of inflation.

The average price of coca-cola during this period of time, adjusting for inflation, has been $1.89, and the most current price of $2.69 is 42.33% above that average.

https://moneynotmoney.com/historical-price-of-coca-cola-in-united-states/

Inflation? Bullshit. Price gouging.

Yeah, don’t give me that bullshit. That’s the same excuse Galen Weston used only a few years after they were found guilty of price fixing bread. Inflation is just an excuse.

New challenges for retailers such as:

Not hitting record profits year after year. Reducing their CEO from a five yacht household to a four yacht household. Finding ways to hardline lobby to reduce taxes to zero.

Hah. Like the CEOs will bear any brunt of this burden.

more like, this year the CEO can’t upgrade to a 7-yacht household like planned and will have to be happy with merely upgrading to six yachts, a plane, and two Mazeratis

Question for the economists in this thread. Everyone seems to be saying that a lack of at least some inflation is bad but also that wages going up to meet it is bad. Isn’t this a system automatically doomed to fail? Eventually in such a setup no one can afford anything and the economy collapses.

Inflation is fine as long as wages rise with it.

The issue is our economy is entirely built around low interest rates and low inflation. It’s been that way for a generation. This benefit asset-holders like home owners and the wealthy. Hence why they are doing everything possible to avoid wage-growth. They don’t care about inflation, what they are terrified of is wage growth and higher interest rates.

If wages rise together with inflation you get hyper inflation.

No, that’s nonsense. Wages going up are not going to cause 1,000% inflation per year.

I hate to agree with the other guy, but we just saw massive inflation during pandemic because corps refuse to eat ANY loss in profit. It’s all fucking greed.

A big part of that was greed, but not due to rising wages as the poster suggests. Real wages (which means inflation adjusted) did rise sharply in the immediate time after the pandemic recession, but stabilized by 2022.

There were legitimate bottleneck issues that caused some prices to rise. Companies then saw that they had a once in a century opportunity to raise them even more and blame bottlenecks. Despite what a lot of people think, companies can’t raise prices arbitrarily in most circumstances. They’ll just lose customers. This particular situation, though, meant that everyone could do it at once and customers would just have to bear it.

But it will and there’s plenty of precedent, like Weimar Republic.

That’s not how that works. That’s not at all how that works.

Right… Well, enlighten us all! Maybe you’ll get a prize or something for disproving economists!

Waving your hands around and saying “Wiemar Germany inflation” is the economic equivalent of “Rome fell because feminisim/immigration/too many homosexuals/not enough homosexuals/Christianity/didn’t use Heron’s steam engine/lack of Starbucks”. It’s brought out by people with an agenda and a willingness to twist any historical fact to make things fit that agenda.

No, that was because of high volumes of money printing to pay debts.

Yeah, debts to workers.

Are you just making up “facts” as the contradictions flow? Or did someone else make up these “facts” and you just parrot them?

Debts to other countries. Apparently, you don’t know the first thing about how that happened.

Not an economist per se, but what my econ prof in college put on the test is, more or less, that workers’ penury will eventually force them to take action to raise wages. This includes everything from strike actions to workers in general simply refusing to take the lowest-paid jobs anymore. The fact that employers will delay this process as long as possible and keep the raises as small as possible and workers will have to fight like hell to get even pitiful raises is also part of the theory. It’s a story of gIvE aNd tAKe that ignores the government took massive action last year to prevent the labor market from responding to the new market conditions and routinely acts to prevent wages from rising “too fast.” The price of everything can inflate to hell, but if the price of labor goes up in direct response just like every other commodity, whoa now, stop the presses, that’s an economic problem.

Some inflation is necessary to prevent wealth hoarding. It’s one reason we moved away from the gold standard.

Minimum wage needs to be tied to it though because we’re still seeing a huge amount of wealth disparity which is exactly what inflation is meant to solve.

Inflation doesn’t prevent wealth hoarding. In fact it benefits non-cash assets which the rich hoard plenty.

That’s an issue with non-cash assets (like cash was when we moved away from the gold standard). And why Bernie suggested they be taxed heavily.

But the intention of inflation, was to prevent the hoarding caused by the gold standard.

How does reducing the value of cash prevent hoarding of gold (which would be worth more cash then)?

It’s not to prevent hoarding gold, it’s to prevent hoarding money. When tied to the gold standard when gold is worth more, money is worth more, and vice versa. By not selling my gold (or using my money), the gold (and cash) in circulation becomes artificially worth more, as the law of supply and demand dictates. This encourages the hoarding of cash because your money becomes more valuable the less money is in circulation.

The paper standard solves this through yearly inflation and decommodifying money. Commodities are subject to the law of supply and demand. Paper money isn’t and shouldn’t be. When both currency and the things we buy with currency are subject to the law of supply and demand, the system breaks down, essentially.

So, we no longer tie money to commodities. A lesson we learned the hard way, unfortunately.

But then they just hoard real estate.

You’re right, and it’s basically a loophole in the system. It should be fixed.

Inflation is easier to handle and not as bad for the economy as deflation, so that’s where we are always at.

2% inflation and 2.5%-3% wage gains where the difference is made up by productivity gains would be the ideal.

The thing people are scared of is a wage-price spiral where inflation is 10% so wages have to rise 10% which increases employer costs so they raise prices 10% so wages have to rise 10% etc. High inflation that becomes self-perpetuating.

Wages rising faster than inflation is good, but the risk of a wage-price spiral is what people are afraid of with rising wages.

The problem is credit. People and government buying things not with money but credit. Basically IOUs from a parent to a child. In this metaphor it’s like our shitty fucking parents paying home security bills amd groceries with credit cards and using cash for the casinos.

I honestly don’t get it. Why do prices have to go up even if wages don’t? It seems like some people say that some kind of inflation is absolutely necessary no matter what.

It’s nearly impossible for us to maintain the value of money. More is printed every day, much is destroyed at a rate that can’t be tracked, and the economy is fucking complex. Because of all that it will either be in an inflationary or deflationary state at any given moment

Generally speaking inflation is better overall than deflation, so we try to keep a low inflation rate going so it’s not out of control and doesn’t enter deflation

They don’t HAVE to go up, but inflation is helpful to the economy and deflation is harmful. With deflation everyone stops spending because their dollar will buy more tomorrow, and that lack of activity hurts the economy.

With a little bit of steady inflation it encourages spending, but wages tend to keep up so it doesn’t actually hurt people.

Also those times when inflation outpaces wage growth are theoretically helpful (in a market that doesn’t have other failures) because if wage growth has stalled that means the value of that labor to the employer has decreased, and inflation helps reset that value calculation without making it a normal thing for companies to reduce your wage at an annual review, think of how hard that would be to budget for.

I really want to know where people got the idea that people would stop spending because their money is supposedly worth 2% more after a year. The only examples I see given are things like economic downturns (i.e. credit freezes and layoffs), where there is deflation because people are spending less for reasons other than deflation. To give an example of deflation not being harmful, just look at technology. Technology gets better and cheaper all the time, but it’s not like nobody is buying technology, quite the opposite in fact.

I’ve read that it’s a debt problem more than anything else. The world runs on credit, and inflation decreases the debt burden. When dollar value goes down thanks to the inflation, the value of the debt also goes down so it becomes easier to pay off (at least for those who do get inflation raises…). So essentially the rich get richer thanks to inflation.

That’s factored into the interest rate of loans. Inflation only decreases the debt burden when inflation increases higher than the average rate AND the one who needs to pay is actually getting more money. What’s the difference between a loan with a 6% interest rate when there’s 2% inflation and a loan with a 2% interest rate when there’s 2% deflation?

Because profit.

Not an economist at all. I can’t say anything about refusing to raise wages, I don’t know for sure that wages increasing to match inflation is bad for anyone except the capitalist class.

Inflation being more desirable than deflation is simple enough though. If prices are constantly, slowly, going up, it means that your purchasing power with an amount of money is always highest right now as opposed to in the future. This encourages spending - why wait to buy this thing in going to buy anyway, if it’ll be 3% more expensive next year? The one thing we absolutely don’t want is people just hoarding money, sitting on it because prices will go DOWN tomorrow. This leads to a stagnant economy, where there’s no money moving, and that’s bad for everyone.

And yet we have a whole class of people who hoard the most money.

I’ve heard this argument in economics videos, but if you think critically, you can’t wait to buy necessities no matter what way the dollar is moving. And even in an inflationary environment things that you can wait for will go down in price over time. They’ll age, newer versions will come out, a used market starts up for it, etc. So waiting for prices to come down doesn’t seem to be related to inflation at all.

And to give a more concrete example, think of the speed of inflation (assuming 2%/year). Well if we had a year of deflation at 2%, why would I wait an entire year for my $1000 product to be $980. The savings is a pittance.

Most of economics assumes perfectly rational actors capable of making these delayed purchases. It’s a bit reductive for sure, and hard to say how much the real world maps to the theory, but the logic works assuming those caveats.

They tighten their belts, we tighten our belts, everybody loses. All because they got to have all the money and never leave anything on the table for the working class.

Pay board members less. There you go, you now have more money to pay employees.

I’m sorry, I don’t understand.

Perhaps you could try again, in english?

/Executive

The people that represent the shareholders. You know? The fickle group that changes its mind or gives conflicting directions week to week?

Ohhh i know who you’re talking about. No can do buddy. They’ll fire me if I even suggest it. No way I lose this sweet gig.

/CEO

Yall made your nut with pandemic price hikes, now eat your fuckin crow.

They won’t. They will continue to cut costs by skipping health and safety requirements and laying off employees. There must always be profit.

There must always be as much profit as possible no matter who suffers*

It’s time to stop spending.

I’ve cut back on everything, not just because its expensive but because I want to send a message.

If even 10% did this, the corps would shit themselves bloody.

100% agree. I have personally stopped eating fast food months ago. The quality is the worst it has ever been and it is outrageously priced. Same goes for soda, chips, and other junk food. Junk food was supposed to be cheap. When you stop making it cheap…you don’t have a consumer base.

It is “insane” over here in the Netherlands also;

- MC donalds “standard” menu; ±/ 15 Euros (used to be around 8-10 euros)

- Dominos Pizza medium “special”; 15+ Euros (used to be around 10 euros for the same pizza)

It’s already close to a price hike of 50+ percent.

Went out to dinner with a few friends to a Korean BBQ place; 40 euros for all you can eat per person. It was nice but the amount of food that one should eat to get to the 40 euro treshhold is insane. I think I ate for a maximum of 15 euros of food.

Other places also aggressively jacked up their prices for the exact same menu and quality (or lack of). I just cannot be arsed anymore to eat out.

The new fastfood prices are getting closer to the restaurant prices pre inflation. I don’t see any incentive to actually pay those prices for the lack of quality of the food.

I also see that the same fastfood chains ‘quietly’ implemented shrinkflation in regards of toppings or portion sizes so one gets screwed over double.

I liked to get some fastfood once or twice every 2 weeks, but I just cannot be bothered anymore.

the kicker is that for that 15 euros worth of fastfood I can get close to a weeks of selfcooked dinner.

I already see some grocery stores actually lowering the prices of certain items and aggressively put items on huge discounts.

I was actually thinking the other day I don’t actually like McDonald’s food, except the milkshakes, I just go there all the time.

I would genuinely rather just go to pizza hut, it’s basically the same price these days and at least you get more food for your money.

When’s the last time the US saw significant deflation? The 30’s? Can’t say I blame them for their fear. But they’ll see no sympathy from me! We’ve seen two whole generations born, raised, and passing away in the age of “Number always go up!” business. At least the greatest generation grew up hearing stories of difficult times when it was the unions and collectives that brought them through the darkness. I’m sure current business leadership has no clue how to face this. It’s passed out of living memory.

You can see the massive deflation happening in China right now as youth unemployment hits 25%.

No thanks. We don’t want that over here. Inflation is (and always will be) better than mass unemployment. If you want lower prices, open up our trade with others (IE: Import China’s goods since they’re suffering from deflation: we can benefit from those lower prices).

What are the root causes of that deflation though? I would posit the over extension of the Chinese economy in an effort to mimic “Number go up” results without the required fundamentals (see evergrande).

I see “inflation is good” parroted a lot, without much analysis as to why. I understand how continual inflation is a major driver of modern western economies, and those steering those economies require it to support current polocies and the general status quo. However, that being said, I fail to see how that makes it required for things to be “OK”.

The price of a raspberry “inflates” in the winter, and “deflates” when in season. The price of commodity consumer electronics is in a continual state of deflation, as new teohnology emerges. At the microcosm prices move in both directions frequently, and are just deemed adjustments. Why then, at the macro scale is a continual increase in pricing considered a sign of economic health?

You’re getting supply and demand confused with inflation.

Inflation is a rise in the general price of goods. One item changing price (like a Taylor swift concert ticket) isn’t inflation, especially peak pricing.

Explaining it is much more than a commet length, but ill try before my phone dies.

As gdp increase (better efficiency, more good sold, new markets, value add services) more people are employed to do this work. Unemployment falls when this exceeds the growth of a population from either new people entering the workforce or immigration and against retirement and death. Okuns law.

As Unemployment falls, inflation increases. Less people employers are fighting over means perks and wages increase, driving inflation and costs of production. Phillips curve relationship.

Effectively, economic growth results in inflation.

If I had more time, changing the OCR affects components of GDP, changing inflation through these methods. But there is alot that goes into the logic.

“Inflation is good” from the perspective of Government fiscal policy.

Paying out interest on a AAA-rated loan (e.g. US bonds) is quite cheap, often below the national inflation rate. It allows (in theory) Governments to make large investments - like infrastructure - that work to increase their national GDP, which in turn can lead to increases in their tax-base, making it easier/cheaper to service their loans in the future.

So if the US issues a $1b bond, payable at 10yrs - with inflation at ~3%, the “value” (purchasing power) of that money would have decreased by over 25%.

Removed by mod

Agreed.

But China will try anyway. Some geopolitical moved are obvious.

TEMU is a symptom of this obvious policy for example

I thought the US loved free trade? Oh, only when it benefits the corporate masters, I see.

Removed by mod

Yeah, I was being facetious and poking fun at the claim that the US is all about free trade. It’s the claimed reason any time the US makes an agreement to screw over local labor which they label as “not competitive” i.e. corporations don’t want to pay American wages but want to sell to the American market.

Profits must always go up.

Guillotine’s can also go up.

I like it best when they come down.

The spice must flow

Blood for the blood god!

Fuck retailers. Have less shareholder profit and get over it. They want profit to be fixed or increasing. They view it in an accounting sense as something they cannot have decrease, ever. This is unrealistic and makes them do stupid things.

There is no sin greater in capitalism than uncaptured profit, none.

Fuck capitalism and the barbaric world it creates. We are better than this but the sociopaths like to count big numbers.

Only stupid to those not benefitting from it. Like most of us.

If its stupid to most people then the ones continuing to promote it have mental illness.

I thrift pretty hard now.

Even thrifting is expensive now. The truth is, there’s nowhere to cut and that’s why it’s hurting so many people.

The hell? Where are you thirfting? The Goodwills near me sell clothes for less than $3 per garment. Toys are less than $5. Movies are a dollar, games are $5 per title, what state are you in?

Chickpeas, soyflakes, rice, hemp & chia seeds, quinoa, tofu, lentils, flour. Most of the dried goods have a shelf life of 1-2 years. The cost of them is sinking in germany. I’m fine with people complaining about rising cost of meat, eggs and dairy and ignoring that fine sources of protein, minerals and vitamins. More for me.

Do lentils have much taste?

They’re like beans.

While having them home cooked is better, try some prepackaged Indian or Middle Eastern foods that might have them from a local health food store. Regular grocery stores might have them in some canned soups.

I’m personally not a fan of lentils, I find them somewhat dry/mealy in consistency, but I’m not going to turn down a good dish with them in it.

I honestly have never had beans. The only vegetable I’m good with is hummus, but I’m super curious about vegan/vegetarian proteins. I won’t start with lentils, though. Sounds unpleasant for someone with texture issues. Thank you.

Hummus is made with beans.

My brother in christ, it’s garlic and chickpeas. I’m choosing not to call them garbanzo beans but specifically peas. Tho, yes, but it’s all blended and shit.

Peas and beans are both legumes and there’s no reason to separate them biologically into two types the way we do it.

Protein is made up of about 20 amino acids. Your body can produce 11 of them itself. You need to ingest 9 of them, the so called essential amino acids.

Meat usually contains the complete protein, as well as soy (tofu, edamame, tvp) does. But there are others like quinoa or hemp seeds.

Other plant based protein sources like legumes, beans, peas, grains, seeds & nuts need to be combined to get the 9 EAA because they all are a bit deficient in mostly one amino acid (but they too contain all of them). That’s why beans and rice are often eaten together:

https://www.piedmont.org/living-real-change/what-is-a-complete-protein

I would look into tofu and TVP (textured vegetable protein). The latter is made up of soy but comes in the form of crumbs of varying sizes. It’s dirt cheap here and high protein. If you get the finer grained, you can process them into stuff that resembles ground meat. You can make bolognese, casseroles or burger-patties (in combination with a binding agent like aquafaba or linseeds, onions, mushroom) out of it.

If you don’t want to cook you could make shakes with a food processor or smothie mixer. Plantbased protein powder (pea/rice/soy) + fruits, seeds cocosmilk etc.

I’d install the app cronometer and get a kitchen scale if you don’t have it.

Cronometer contains a gigantic database of products you can easily enter by scanning the barcode. The database is contributed to by users. I can tell they seem to be strict with the quality-control of the contributed products. I contributed one 3 weeks ago and it’s still not in the DB although I looked at pretty in depth websites for the micro nutrients and triple checked the units and numbers.

So you enter your body data and it tells you what your goals are. You can set individual targets, e.g. protein according to your level of activity. You can track workouts too which then modify your macro goals accordingly. You can enter the ingredients of a recipe, save it and restore it when you cook it again. I made myself one e.g. for morning cereals which let me meet my overall daily protein and overall target of 30-40% already. With a daily report it tells you down to the individual vitamins, minerals, fatty acids and amino acids what you need. All in the free version.

What you need to do yourself is to find out what micro and macro nutrient is in what product. Cronometer gives you hints if you click on them in the daily report. You don’t need to track forever as it’s sure cumbersome but to get a feeling for proper nutrition it’s an eyeopener.

In forgot vital wheat gluten alias seitan which a bite of would probably obliterate a gluten sensitive person. It’s often used in convenience food.

It’s made out of flour and nothing much else and it happens to have the highest amount protein per gram among the plant based products and even higher than some meat products. The problem is the amino acid profile:

Most of the listed foods don’t have much taste on its own. And nobody should eat them unprepared. RememberTheApollo_ described it well. But spices are a thing. With them you can transform them into culinary experiences.

Combine chickpeas with cumin, lemon juice, olive oil, tahini/peanut butter and garlic: delicious nurturing Hummus.

Combine chickpeas with parsley, onion, garlic, cumin, coriander, pepper and sesame seeds: mouth watering falafel.

Combine tomatopaste, oliveoil and spices to get a nice base for frying crumbled tofu (a complete protein) to emulate ground meat.

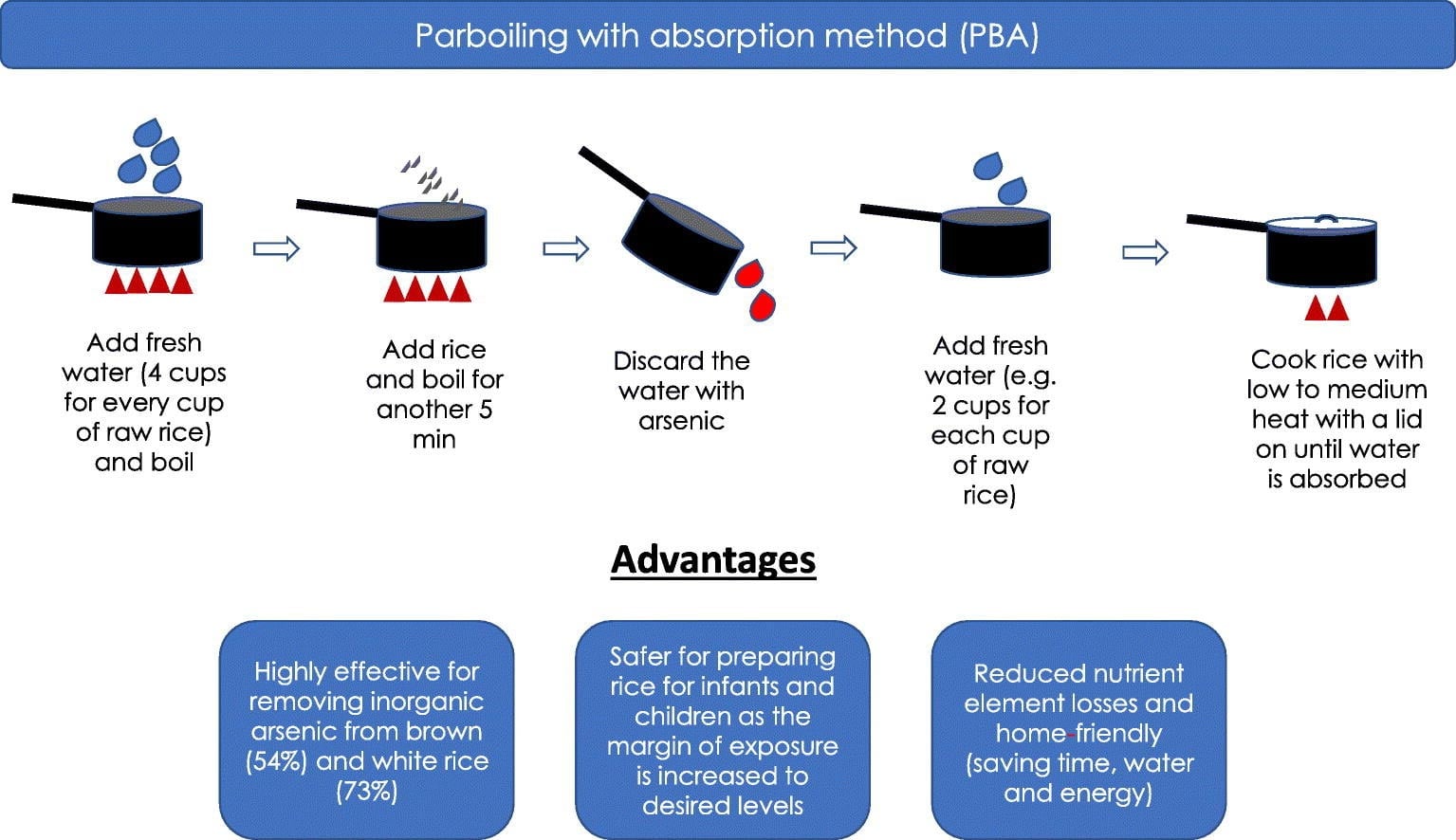

With all the dried food it’s important to prepare them correctly (rinse, soak, cook) to get rid of plant toxins like phasin, solanin, oxalates or arsenic.

E.g. a study found out the best way to prepare natural rice. Peeled rice doesn’t contain much arsenic but natural/brown rice may contain it in its shell (amounts vary by its country of origin).

Not really, but that can be a positive if you know how to spice food properly. I make a lentil taco recipe in the instant pot and it comes out pretty good as long as I don’t forget any of my spices.