- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

Americans failed to pay $688 billion in taxes on their 2021 returns, a record level, according to a new estimate from the IRS. The agency said that it is taking “urgent” steps to increase compliance such as auditing more high-income taxpayers as well as businesses and partnerships.

The $688 billion estimate reflects the first time the IRS is providing information about the so-called tax gap on an annual basis, with the agency noting in a Thursday statement that it plans to continue providing the data on a yearly basis. The number reflects an increase of more than $138 billion from estimates for tax years 2017 to 2019, the agency said.

So they’re gonna focus on auditing rich people and corporations, right?

The agency said that it is taking “urgent” steps to increase compliance such as auditing more high-income taxpayers as well as businesses and partnerships.

Straight from the article

Which begs the question why this is a new thing, going after the bigger fish. I’ll bet part of the answer is lawyers, i.e going after lower income is easier because they don’t have ways to defend themselves. Or access to methods in hiding the money.

It’s because the IRS has constantly had their funds cut, yet they still have to collect money. So, go after the big dogs and spend a load of money and get nothing? Or, go after the little guys who will shut up and just pay?

I’m a little more cynical, so I’m guessing it’s because rich people and businesses have more influence of politicians, and politicians have influence over the IRS. I doubt it’s a coincidence that conservative media has targeted the IRS so aggressively over the past year or so.

I’m more cynical because I think that high up are safe. Somewhere in the middle, the millionaires and small business, are probably the new targets. The change could also be simply because the lower end that are easy to do also more and more can’t even pay the fines, so it’s dried up.

The IRS has been struggling with funding since the GOP took power in the House in 2010. They defunded the IRS, and for millions of sadly-voting idiots in the US, “Fund the IRS” sounds scawwy.

Jimbo making 33k a year is very much against estate tax, millionaire tax and the big bad IRS coming for his capital gains.

I’ve literally heard that they’re on record about this—they simply don’t have the resources to take on big fish and their extremely well-funded legal protection, so they default to low income and middle income audits. It’s a total joke.

The IRS is hiring 30,000 people over the next 2 years so the previous staff shortages will be wiped out.

I like them saying they’ll do it. I’ll like it even more if they actually do! There’s a reason they target lower income people without scummy lawyers on retainer: doing the right thing (and funding our government) is hard. We’ll be watching…

Did the article define 'high-income taxpayer"?

Yes

Only if you read it, though 🤷♂️

Yes, it’s always been people making 400k and up. This has been know since they hired more IRS agents and it’s the main reason Republicans had a shit fit about it.

deleted by creator

In my company of 2000 people, roughly half are six-figure engineers… only two people make about 400k income a year.

hope they’re paying their taxes >.>

Hard to do when they get defunded etc.

lol, good one

“Expect more audits” …for people who earn $400k and up.

So basically normal people don’t have to expect any changes, a bunch of rich peoples’ accountants do.

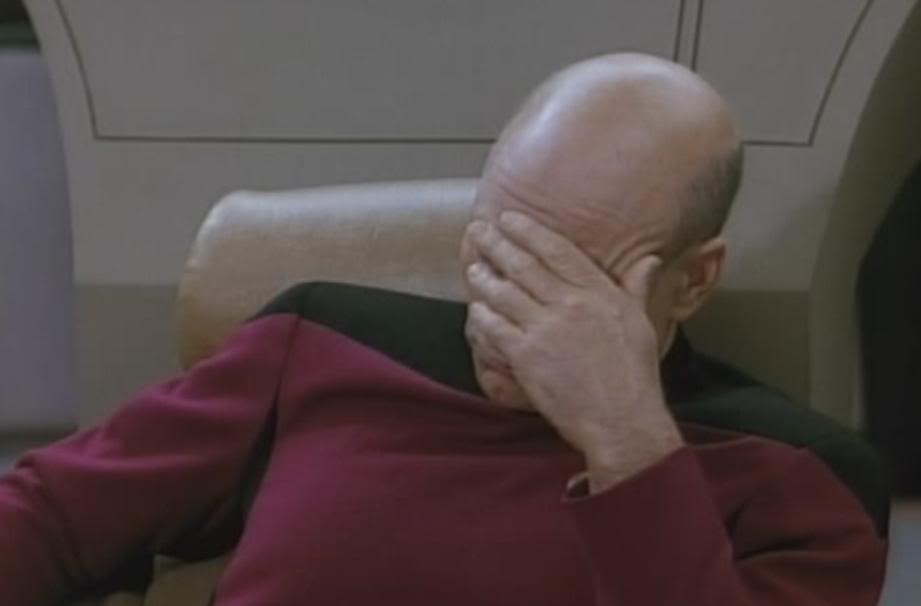

Oh noooo

Anyway.

They say that each and every capable person put into the tax audit department will be a money making machine for the IRS. Maybe it’s time to test this myth.

That’s $2000 per American (including children and elderly)

How does that happen?

Wealth disparity.

I’m all about anti corruption campaigns. We could have actually functional infrastructure and healthcare if the wealthy actually paid their taxes.

deleted by creator